Laporan Keuangan Koperasi Simpan Pinjam (KSP) 2025: The Lowdown

Contoh Laporan Keuangan Koperasi Simpan Pinjam 2025 – Yo, peeps! Let’s dive into the world of cooperative financial reports. Understanding a KSP’s financial health is, like, totally crucial for its survival and growth. Think of it as a financial checkup – you wouldn’t skip a doctor’s appointment, right? This report gives you the 411 on the KSP’s financial standing in 2025.

Marsihuta, Contoh Laporan Keuangan Koperasi Simpan Pinjam 2025 patut dipelajari secara saksama, agar pengelolaan keuangan tetap sehat dan terarah. Data-data di dalamnya menjadi acuan penting bagi perkembangan koperasi. Perlu juga dibandingkan dengan lembaga keuangan lain, misalnya dengan melihat penawaran pinjaman dari Bank Perkreditan Rakyat (BPR) yang tertera dalam Brosur Pinjaman Bpr 2025 , untuk melihat strategi pengelolaan dana yang lebih efektif.

Dengan begitu, Contoh Laporan Keuangan Koperasi Simpan Pinjam 2025 akan lebih komprehensif dan memberikan gambaran yang lebih jelas tentang keuangan koperasi di masa depan.

We’re gonna break down the main components, give you a simplified example, and then spill the tea on the challenges and opportunities KSPs face in 2025. It’s gonna be lit!

Komponen Utama Laporan Keuangan KSP

Okay, so KSP financial reports usually have three main parts: the balance sheet (neraca), the income statement (laporan laba rugi), and the cash flow statement (laporan arus kas). These are like the holy trinity of financial info, providing a comprehensive picture of the KSP’s financial performance. Knowing these is key to understanding the whole shebang.

- Neraca (Balance Sheet): This shows what the KSP owns (assets), what it owes (liabilities), and the difference between the two (equity). Think of it as a snapshot of the KSP’s financial position at a specific point in time.

- Laporan Laba Rugi (Income Statement): This shows the KSP’s revenues and expenses over a period of time, revealing whether it made a profit or loss. It’s like a summary of the KSP’s financial performance for the year.

- Laporan Arus Kas (Cash Flow Statement): This tracks the movement of cash in and out of the KSP over a period. It’s all about the money flow – where it came from and where it went. It’s super important for understanding liquidity.

Contoh Ilustrasi Neraca KSP Tahun 2025

Let’s get real with a simplified example. Imagine a KSP in 2025. This is just a *totally* hypothetical example, okay? Don’t take it as gospel truth.

Tungkup ni Contoh Laporan Keuangan Koperasi Simpan Pinjam 2025, patut diulas secara teliti, marisi angka-angka na mangungkap keuangan kita. Di dalamnya, terlihat juga dampak dari peningkatan pinjaman, termasuk pinjaman yang dijamin oleh SPPT tanah. Hal ini sangat berkaitan dengan kemudahan akses kredit melalui program Pinjaman Jaminan Sppt Tanah 2025 , na mangatur bagas ni paruntungan hita.

Data ini sangat penting untuk memperkirakan keuangan Koperasi di tahun-tahun mendatang. Jadi, pengkajian Laporan Keuangan Koperasi Simpan Pinjam 2025 haruslah dilakukan dengan cermat dan bijaksana.

| Aset (Assets) | Liabilitas (Liabilities) | Ekuitas (Equity) |

|---|---|---|

| Kas: Rp 100.000.000 | Simpanan Anggota: Rp 150.000.000 | Modal: Rp 50.000.000 |

| Pinjaman yang Diberikan: Rp 200.000.000 | Hutang: Rp 20.000.000 | |

| Total Aset: Rp 300.000.000 | Total Liabilitas: Rp 170.000.000 | Total Ekuitas: Rp 130.000.000 |

Remember, this is a super basic example. Real-world balance sheets are way more detailed.

Marhusip ni angka-angka di Contoh Laporan Keuangan Koperasi Simpan Pinjam 2025, patut dipelajari secara saksama, hita makkam hasonangan bagi perkembangan ekonomi. Pengetahuan tentang pengelolaan keuangan yang baik, tarlumobi bagi hita mangka marsiajar dari referensi lain. Misalnya, hita boi mangka manghalompak informasi dari Brosur Pinjaman Wom Finance 2019 2025 , na i mangalehon gambaran tentang strategi pinjaman modern.

Hal ini boi mangurupi hita dalam memahami aspek keuangan yang lebih luas, sehingga lapuran keuangan Koperasi Simpan Pinjam hita boi makin tertib dan jelas di taon 2025.

Perkembangan Koperasi Simpan Pinjam di Indonesia Tahun 2025

Alright, let’s talk about the big picture. We’re assuming (because it’s 2023 and we’re looking into the future) that by 2025, Indonesian KSPs will experience significant growth, driven by increased financial inclusion and digitalization. More people will be using digital banking, which means more peeps will be using KSPs. However, this growth will also come with its own set of challenges.

Di taon 2025, laporan keuangan Koperasi Simpan Pinjam harus tertib jala, ihat angka-angka na saring. Hal on penting bagi kelangsungan usaha, hita patut manganjurhon kehati-hatian. Sebagai perbandingan, angka keuangan kita bisa dibandingkan dengan lembaga keuangan lain, misalnya dengan melihat penawaran Pinjaman Bank Bpr 2025 , supaya hita mungkin memperoleh gambaran yang lebih jelas.

Dengan demikian, Contoh Laporan Keuangan Koperasi Simpan Pinjam 2025 bisa dibuat lebih akurat dan bermanfaat bagi perencanaan di masa mendatang.

Tantangan dan Peluang KSP di Tahun 2025

The future isn’t all sunshine and rainbows. KSPs in 2025 will face some serious challenges, but also some major opportunities. It’s a mixed bag, for sure.

- Challenges: Increased competition from banks and fintech companies, managing non-performing loans (NPLs), maintaining cybersecurity, adapting to changing regulations.

- Opportunities: Expanding into new markets, leveraging technology to improve efficiency, offering innovative financial products and services, strengthening member relationships.

Format Laporan Keuangan KSP 2025: Contoh Laporan Keuangan Koperasi Simpan Pinjam 2025

Yo, peeps! Let’s dive into the nitty-gritty of cooperative financial reports. Think of this as your ultimate guide to understanding the financial health of a KSP (Koperasi Simpan Pinjam) in 2025. We’re gonna break down the key reports – balance sheet, income statement, and cash flow statement – in a way that’s totally relatable, even if you’re not a total accounting whiz. It’s all about getting that financial picture crystal clear, so grab your notepad and let’s get this bread!

Di tahun 2025, Contoh Laporan Keuangan Koperasi Simpan Pinjam menjadi sangat penting, menunjukkan kesehatan finansial suatu koperasi. Keberhasilan pengelolaan dana sangat bergantung pada transparansi dan akuntabilitas. Bagi warga Cirebon yang membutuhkan akses pinjaman, informasi mengenai Koperasi Simpan Pinjam Di Cirebon Tanpa Jaminan 2025 sangatlah berharga. Dengan begitu, studi Contoh Laporan Keuangan Koperasi Simpan Pinjam 2025 dapat membantu memahami bagaimana koperasi tersebut mengelola dana dan memperoleh keuntungan, sekaligus memberikan gambaran tentang keberlanjutan bisnisnya di masa mendatang.

Memahami laporan keuangan ini juga penting bagi calon anggota untuk mengevaluasi kepercayaan terhadap lembaga tersebut.

Neraca KSP Tahun 2025

The balance sheet, or what some folks call a “snapshot,” shows a KSP’s financial position at a specific point in time. Think of it as a picture of their assets (what they own), liabilities (what they owe), and equity (the owners’ stake). It’s all about that sweet balance, ya know? This is where you see if they’re totally stacked or kinda struggling. Here’s a detailed breakdown of the accounts you’ll typically find:

- Assets: Cash on hand, accounts receivable (money owed to them), investments, property, plant, and equipment (PPE – like their building and computers), and other assets.

- Liabilities: Accounts payable (money they owe), loans payable, member deposits (money members have deposited), and other liabilities.

- Equity: Member equity (the members’ ownership stake), retained earnings (profits kept in the business), and other equity accounts.

A well-structured balance sheet ensures that Assets = Liabilities + Equity. It’s all about that equilibrium, fam!

Laporan Laba Rugi KSP Tahun 2025

The income statement, or profit and loss (P&L) statement, shows a KSP’s financial performance over a period of time, usually a year. It’s all about the money coming in (revenue) versus the money going out (expenses). The difference? That’s your profit or loss, which will show if they are making bank or facing a major setback. This is a comprehensive overview to keep things on track.

- Revenue: Interest income from loans, membership fees, and other income sources.

- Expenses: Interest expense on borrowed funds, operating expenses (salaries, rent, utilities), and other expenses.

- Net Income/Loss: The bottom line – the difference between revenue and expenses.

Laporan Arus Kas KSP Tahun 2025

The cash flow statement shows how a KSP’s cash changed during a period. It’s not just about profits; it’s about the actual cash coming in and going out. We’ll look at both the direct and indirect methods for calculating this.

Marhuta, laporan keuangan koperasi simpan pinjam taon 2025 memang sada hal na penting dijaga. Ingkon sada, data-data keuangan na ringkas jala jelas, supaya pengelolaan uang koperasi terlihat transparan. Untuk memudahkan pencatatan, sangat dibutuhkan sistem yang teratur, misalnya dengan menggunakan Contoh Buku Koperasi Simpan Pinjam Excel 2025 yang tersedia secara online.

Dengan buku digital ini, proses pembuatan laporan keuangan koperasi simpan pinjam taon 2025 akan lebih efisien dan akurat, sehingga keseluruhan laporan keuangan nantinya akan lebih terpercaya dan mudah dipahami oleh semua anggota.

- Direct Method: This method directly tracks cash inflows and outflows from operating, investing, and financing activities. Think of it as a detailed record of every cash transaction.

- Indirect Method: This method starts with net income and adjusts it for non-cash items to arrive at cash flow from operations. It’s like taking a shortcut, but still gets you to the same destination.

Both methods give you a clearer picture of the KSP’s cash position, which is super crucial for their long-term survival and sustainability.

Perbandingan Format Laporan Keuangan KSP dengan Perusahaan Konvensional

While KSPs and conventional companies both use similar financial reports, there are some key differences. For example, KSPs often focus more on member equity and social responsibility aspects. The overall structure remains similar, but the specifics and reporting emphasis can differ.

| Item | KSP | Conventional Company |

|---|---|---|

| Focus | Member welfare, social impact | Profit maximization, shareholder value |

| Equity | Member equity prominent | Shareholder equity prominent |

| Reporting | May include social performance indicators | Primarily financial performance indicators |

Penyajian Informasi Laporan Keuangan KSP dengan Standar Akuntansi yang Berlaku

KSPs should follow generally accepted accounting principles (GAAP) or equivalent standards to ensure transparency and comparability. This means using consistent accounting methods, clear presentation, and full disclosure of all relevant information. Following these standards builds trust and credibility with members and stakeholders. It’s all about keeping it real, fam!

Di tahun 2025, Contoh Laporan Keuangan Koperasi Simpan Pinjam menjadi sangat penting untuk dikaji, mengingat perkembangan ekonomi yang dinamis. Penting bagi kita untuk memahami seluk-beluk pengelolaan keuangan, terutama jika kita membandingkannya dengan sistem pinjaman yang lebih modern. Perlu diketahui, bahwa perkembangan teknologi turut mempengaruhi akses keuangan, seperti yang dibahas dalam Artikel Tentang Pinjaman Online 2025 , yang menjelaskan berbagai aspek pinjaman online.

Memahami keduanya, baik laporan keuangan koperasi maupun sistem pinjaman online, akan membantu kita dalam mengambil keputusan keuangan yang bijak, sehingga Contoh Laporan Keuangan Koperasi Simpan Pinjam 2025 dapat dianalisa dengan lebih komprehensif dan akurat.

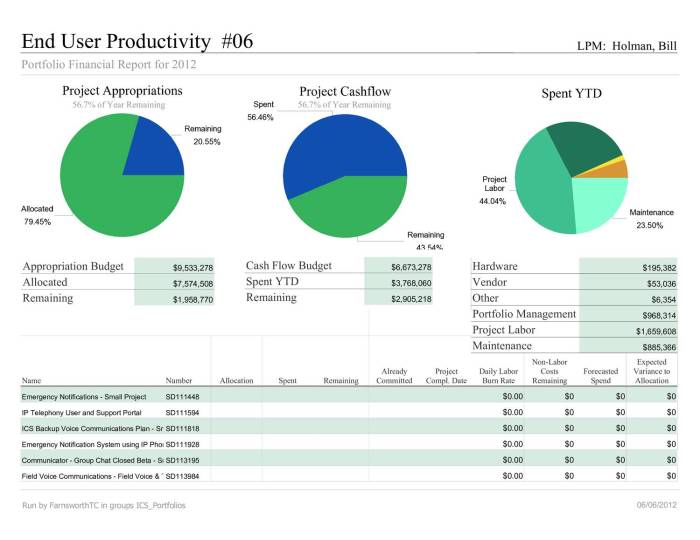

Contoh Angka dan Data Laporan Keuangan KSP 2025

Yo, what’s up, peeps? Let’s dive into some totally realistic (but totally made-up) financial reports for a credit union in 2025. Think of this as a sneak peek into the kinda numbers you’d see – no cap. We’re gonna keep it real with some examples, showing you how the money flows, yo.

Laporan Neraca KSP 2025

This is like a snapshot of the KSP’s financial health at a specific point in time – kinda like a selfie for their finances. It shows what they own (assets), what they owe (liabilities), and what’s left over for the owners (equity). It’s all about the balance, fam.

| Akun | Debet | Kredit | Saldo |

|---|---|---|---|

| Kas dan Bank | Rp 5.000.000.000 | Rp 5.000.000.000 | |

| Piutang Anggota | Rp 20.000.000.000 | Rp 20.000.000.000 | |

| Investasi | Rp 10.000.000.000 | Rp 10.000.000.000 | |

| Perlengkapan | Rp 500.000.000 | Rp 500.000.000 | |

| Kewajiban kepada Anggota | Rp 15.000.000.000 | Rp -15.000.000.000 | |

| Modal | Rp 20.500.000.000 | Rp -20.500.000.000 | |

| Total | Rp 35.500.000.000 | Rp 35.500.000.000 | Rp 0 |

Laporan Laba Rugi KSP 2025

This report shows the KSP’s income and expenses over a period of time – like a financial diary. It helps determine if they’re making a profit or taking an L, you know?

| Pendapatan | Jumlah (Rp) |

|---|---|

| Pendapatan Bunga Pinjaman | 12.000.000.000 |

| Pendapatan Jasa Lainnya | 2.000.000.000 |

| Total Pendapatan | 14.000.000.000 |

| Beban | Jumlah (Rp) |

| Beban Bunga Simpanan | 4.000.000.000 |

| Beban Operasional | 6.000.000.000 |

| Total Beban | 10.000.000.000 |

| Laba Bersih | 4.000.000.000 |

Laporan Arus Kas KSP 2025

This report shows the movement of cash – in and out – during a specific period. It’s all about the flow, dude. It breaks it down into operating activities (day-to-day stuff), investing activities (buying and selling assets), and financing activities (raising capital).

| Aktivitas | Jumlah (Rp) |

|---|---|

| Aktivitas Operasi | 5.000.000.000 |

| Aktivitas Investasi | -2.000.000.000 |

| Aktivitas Pendanaan | 3.000.000.000 |

| Total Perubahan Kas | 6.000.000.000 |

Catatan Atas Laporan Keuangan KSP 2025

Think of this as the fine print, the extra details that didn’t fit into the main reports. It’s all about transparency, fam. This section might include info about accounting policies, significant estimates, and other relevant details.

For example, it might explain the method used to calculate interest income, or provide details on any significant transactions or events that occurred during the year. It’s all about being upfront and honest, right?

Rasio Keuangan KSP 2025

These ratios give a deeper understanding of the KSP’s financial performance. They’re like a deeper dive into those numbers, providing insights into solvency (ability to pay debts), liquidity (ability to meet short-term obligations), and profitability (how much profit they’re making). It’s all about getting the full picture, no shortcuts.

For instance, a high solvency ratio indicates strong financial health, while a low liquidity ratio might suggest difficulty in meeting immediate obligations. Profitability ratios, such as return on assets (ROA) or return on equity (ROE), show how efficiently the KSP is generating profits. Analyzing these ratios helps to paint a more complete picture of the KSP’s financial position.

Analisis Laporan Keuangan KSP 2025

Yo, peeps! Analyzing a KSP’s (Koperasi Simpan Pinjam) financial reports in 2025 is like decoding a super-secret message about its financial health. It’s all about digging deep to see if things are totally rad or, like, totally bogus. We’re gonna break it down, using some totally legit analysis methods, so you can be a financial guru in no time. This ain’t your grandma’s accounting class, this is the real deal!

Analisis Neraca KSP untuk Mengidentifikasi Kesehatan Keuangan

The balance sheet is, like, the ultimate snapshot of a KSP’s financial position at a specific point in time. Think of it as a totally accurate selfie of their financial life. Analyzing it helps us see if they’re financially solid or if they’re, like, totally broke. We’re looking at stuff like assets (what they own), liabilities (what they owe), and equity (what’s left over for the owners). A healthy ratio between these three is, like, the key to a thriving KSP. We need to ensure their assets are greater than their liabilities, showing they are solvent and not drowning in debt. A low debt-to-equity ratio is totally awesome, indicating financial stability.

Analisis Laporan Laba Rugi KSP untuk Mengukur Profitabilitas dan Efisiensi

The income statement, or profit and loss statement, shows how much cheddar a KSP is making (or losing) over a period. It’s like their financial report card. We’re looking at revenue (money coming in), expenses (money going out), and profit (the difference). A high profit margin is totally rad, indicating that the KSP is efficient and making bank. We’ll also check things like their return on assets (ROA) and return on equity (ROE) to see how well they’re using their resources to generate profits. High ROA and ROE are major flexes.

Analisis Laporan Arus Kas KSP untuk Menilai Likuiditas dan Kemampuan Menghasilkan Kas

The cash flow statement is, like, the ultimate real-time view of a KSP’s cash movements. It’s like tracking their cash flow in real-time. We’re looking at cash inflows (money coming in) and cash outflows (money going out). A positive cash flow is totally awesome, showing the KSP has enough liquid assets to cover its short-term obligations and invest in future growth. This shows that they’re not just making money on paper; they’re actually making money they can use. A healthy cash flow is a major key to survival and growth.

Analisis Keuangan KSP Berdasarkan Contoh Angka

Let’s say, for instance, that a KSP has total assets of $100,000, total liabilities of $40,000, and total equity of $60,000. Their income statement shows a net income of $10,000. Their cash flow statement shows a positive cash flow of $5,000. This is a pretty solid picture, showing good profitability, liquidity, and solvency. However, a deeper dive might reveal more nuanced insights.

- High Debt-to-Equity Ratio: If the debt-to-equity ratio is high, it might indicate that the KSP is taking on too much risk.

- Low Profit Margin: A low profit margin might indicate that the KSP’s expenses are too high, or that their pricing strategy is not effective.

- Negative Cash Flow: A negative cash flow is a major red flag, indicating that the KSP is not generating enough cash to cover its expenses.

Identifikasi Potensi Masalah Keuangan dan Saran Perbaikannya

Based on the example, potential problems could include insufficient working capital, leading to difficulties in meeting operational expenses or loan repayments. Another issue could be inefficient expense management, potentially stemming from administrative overhead or loan default rates. Poor investment strategies could also impact profitability. To address these, the KSP could improve its expense management through streamlined processes and better negotiation with suppliers. They could also enhance their loan collection strategies to reduce defaults and improve their investment portfolio to generate higher returns.

Pertanyaan Umum dan Jawaban tentang Laporan Keuangan KSP 2025

Yo, peeps! Laporan keuangan koperasi simpan pinjam (KSP) itu kayak *totally* penting buat ngeliat gimana keuangan mereka selama tahun 2025. Ngerti laporan keuangan ini, kayak punya *cheat code* buat ngerti seberapa *lit* kinerja KSP tersebut. So, let’s dive in!

Komponen Utama Laporan Keuangan KSP

Laporan keuangan KSP biasanya mencakup beberapa bagian utama, mirip kayak *report card* sekolah. Ada Neraca (Balance Sheet), Laporan Laba Rugi (Income Statement), dan Laporan Arus Kas (Cash Flow Statement). Neraca nunjukin aset, kewajiban, dan ekuitas KSP pada tanggal tertentu. Laporan Laba Rugi nunjukin pendapatan dan beban selama periode tertentu, sementara Laporan Arus Kas nunjukin pergerakan uang masuk dan keluar. Semua ini penting banget, *for sure*!

Cara Membaca dan Memahami Laporan Keuangan KSP, Contoh Laporan Keuangan Koperasi Simpan Pinjam 2025

Membaca laporan keuangan KSP itu gak sesulit yang dibayangin, *trust me*. Mulailah dari Neraca. Coba lihat total aset dan liabilitasnya. Bandingkan dengan tahun sebelumnya. Lalu, lihat Laporan Laba Rugi. Apakah KSP untung atau rugi? Berapa besar profit marginnya? Terakhir, lihat Laporan Arus Kas. Dari mana uang masuk dan ke mana uang keluar? Analisa ini bakal kasih kamu gambaran yang lebih *clear* tentang kondisi keuangan KSP.

Perbedaan Laporan Keuangan KSP dengan Laporan Keuangan Perusahaan Lainnya

Secara umum, struktur laporan keuangan KSP mirip dengan perusahaan lain. Tapi, ada beberapa perbedaan. KSP biasanya lebih fokus pada simpanan anggota dan penyaluran pinjaman, beda sama perusahaan manufaktur atau jasa yang fokusnya berbeda. Rasio keuangan yang digunakan juga mungkin sedikit berbeda karena model bisnisnya yang unik. Bayangin kayak bedain *pizza* sama *burger*, sama-sama makanan enak, tapi bahan dan prosesnya beda.

Cara Menganalisis Laporan Keuangan KSP untuk Menilai Kinerjanya

Menilai kinerja KSP bisa dilakukan dengan menganalisis beberapa rasio keuangan. Contohnya, rasio solvabilitas menunjukkan kemampuan KSP membayar kewajibannya. Rasio likuiditas menunjukkan kemampuan KSP memenuhi kewajiban jangka pendeknya. Rasio profitabilitas menunjukkan kemampuan KSP menghasilkan laba. Analisa ini kayak *detective work*, ngungkapin rahasia di balik angka-angka tersebut. Hasil analisa ini bisa kasih kamu gambaran yang lebih *dope* tentang kesehatan keuangan KSP.

Informasi Lebih Lanjut tentang Laporan Keuangan KSP

Buat informasi lebih lanjut, kamu bisa cek situs resmi Kementerian Koperasi dan UKM, atau konsultasi dengan akuntan publik yang ahli di bidang koperasi. Atau, kamu bisa *google it*, banyak banget sumber informasi yang tersedia online. Jangan ragu buat cari tahu lebih dalam, *it’s worth it*!