Dana Bantuan UMKM 2025: Wawancara Eksklusif

Program Dana Bantuan UMKM 2025 diharapkan menjadi angin segar bagi pelaku usaha mikro, kecil, dan menengah (UMKM) di Indonesia. Program ini menjanjikan suntikan dana segar yang signifikan, namun detailnya masih perlu dikaji lebih lanjut. Wawancara eksklusif berikut ini akan mengupas tuntas program yang dinantikan banyak pelaku UMKM ini.

Tujuan Program Dana Bantuan UMKM 2025

Tujuan utama program ini adalah untuk mendorong pertumbuhan ekonomi nasional melalui peningkatan daya saing UMKM. Hal ini dicapai dengan memberikan akses permodalan yang lebih mudah dan terjangkau bagi para pelaku UMKM, sehingga mereka dapat mengembangkan bisnisnya, meningkatkan produktivitas, dan menciptakan lapangan kerja baru. Program ini juga bertujuan untuk mengurangi kesenjangan ekonomi dan mendorong pemerataan pembangunan di seluruh Indonesia.

Target Penerima Manfaat

Program Dana Bantuan UMKM 2025 menargetkan UMKM yang memenuhi kriteria tertentu, seperti memiliki usaha yang legal, berlokasi di Indonesia, dan memenuhi syarat-syarat administrasi yang ditetapkan oleh pemerintah. Prioritas diberikan kepada UMKM yang bergerak di sektor-sektor prioritas pemerintah, seperti industri kreatif, teknologi, dan pertanian. Kriteria spesifik mengenai skala usaha, omset, dan jenis usaha akan diumumkan lebih lanjut melalui kanal resmi pemerintah.

Sejarah Bantuan UMKM di Indonesia

Pemerintah Indonesia telah lama memberikan berbagai bentuk dukungan kepada UMKM, mulai dari pelatihan, akses pembiayaan, hingga fasilitasi pemasaran. Berbagai program bantuan telah diluncurkan, seperti KUR (Kredit Usaha Rakyat), program inkubasi bisnis, dan berbagai program bantuan lainnya yang dikelola oleh Kementerian Koperasi dan UKM serta lembaga terkait. Program Dana Bantuan UMKM 2025 diharapkan dapat menjadi program yang lebih terintegrasi dan efektif dibandingkan program-program sebelumnya.

Rincian Program Dana Bantuan UMKM 2025

Besaran dana bantuan, mekanisme pencairan, dan persyaratan yang lebih detail masih dalam tahap finalisasi. Namun, berdasarkan informasi yang kami himpun, program ini akan menawarkan berbagai skema bantuan yang disesuaikan dengan kebutuhan dan skala usaha masing-masing UMKM. Beberapa kemungkinan skema yang akan ditawarkan antara lain berupa hibah, pinjaman lunak dengan bunga rendah, atau kombinasi keduanya. Proses pengajuan dan verifikasi data akan dilakukan secara online untuk mempermudah akses dan meningkatkan transparansi.

Tantangan dan Antisipasi Program

Meskipun program ini menjanjikan, ada beberapa tantangan yang perlu diantisipasi. Salah satunya adalah memastikan penyaluran dana tepat sasaran dan menghindari potensi korupsi. Pemerintah perlu membangun sistem pengawasan yang ketat dan transparan untuk memastikan dana bantuan benar-benar sampai kepada UMKM yang berhak menerimanya. Selain itu, pemberdayaan UMKM tidak hanya berhenti pada pemberian dana, tetapi juga perlu diimbangi dengan pelatihan dan pendampingan yang memadai agar UMKM dapat mengembangkan bisnisnya secara berkelanjutan.

Dana Bantuan UMKM 2025 diharapkan dapat mendorong pertumbuhan ekonomi melalui peningkatan aksesibilitas modal bagi pelaku usaha mikro, kecil, dan menengah. Perencanaan alokasi dana tersebut perlu mempertimbangkan berbagai faktor, termasuk potensi dampak kebijakan lain seperti program bantuan sosial. Sebagai contoh, informasi mengenai pencairan Bantuan BPNT 2025, yang dapat dilihat pada tautan ini Bantuan BPNT 2025 Kapan Cair , dapat menjadi indikator daya beli masyarakat dan berpengaruh pada perkiraan permintaan pasar.

Oleh karena itu, analisis menyeluruh terhadap program-program bantuan sosial yang berjalan paralel dengan Dana Bantuan UMKM 2025 sangatlah penting untuk memaksimalkan efektivitasnya.

Syarat dan Ketentuan

Mendapatkan dana bantuan UMKM 2025 tentu membutuhkan pemahaman yang jelas mengenai syarat dan ketentuan yang berlaku. Proses pengajuan yang transparan dan terstruktur akan meningkatkan peluang keberhasilan UMKM dalam memperoleh bantuan tersebut. Berikut ini penjelasan detail mengenai persyaratan, proses pendaftaran, dan sanksi yang mungkin berlaku.

Persyaratan Umum UMKM

Secara umum, terdapat beberapa persyaratan yang harus dipenuhi oleh seluruh UMKM di Indonesia untuk bisa mengajukan dana bantuan. Persyaratan ini bertujuan untuk memastikan bahwa bantuan tersebut tepat sasaran dan digunakan untuk tujuan yang produktif.

Dana Bantuan UMKM 2025 dirancang untuk mendorong pertumbuhan ekonomi melalui sektor usaha mikro, kecil, dan menengah. Akses terhadap program ini berpotensi meningkatkan daya beli masyarakat, sejalan dengan tujuan pemerintah dalam mengurangi kemiskinan. Perlu diperhatikan bahwa kriteria penerima bantuan ini berbeda dengan program lain, misalnya Bantuan Pangan Non Tunai (BPNT) 2025 yang memiliki persyaratan tersendiri, seperti yang tercantum pada laman Syarat Penerima Bantuan Pangan Non Tunai 2025.

Oleh karena itu, pemahaman terhadap persyaratan masing-masing program sangat krusial agar penyaluran dana dapat tepat sasaran dan efektif bagi pertumbuhan ekonomi nasional. Keberhasilan Dana Bantuan UMKM 2025 sangat bergantung pada efektivitas pengelolaan dan penentuan kriteria penerima yang tepat.

- UMKM harus terdaftar secara resmi dan memiliki Nomor Induk Berusaha (NIB).

- UMKM harus aktif beroperasi dan memiliki bukti kegiatan usaha minimal selama 6 bulan.

- UMKM harus memiliki rekening bank atas nama pemilik usaha.

- UMKM harus memiliki proposal usaha yang jelas dan terukur, termasuk rencana penggunaan dana bantuan.

- UMKM harus bersedia mengikuti pelatihan atau bimbingan teknis yang diadakan oleh pemerintah.

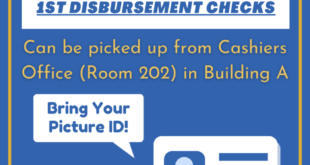

Proses Pendaftaran dan Pengajuan Dana Bantuan

Proses pengajuan dana bantuan UMKM 2025 umumnya dilakukan secara online melalui portal resmi pemerintah. Prosesnya meliputi beberapa tahap, mulai dari registrasi akun hingga verifikasi data dan pencairan dana.

Dana Bantuan UMKM 2025 merupakan program pemerintah yang bertujuan untuk meningkatkan perekonomian masyarakat melalui sektor usaha mikro, kecil, dan menengah. Akses terhadap permodalan menjadi kunci keberhasilan program ini. Namun, keberhasilan usaha juga dipengaruhi oleh faktor-faktor lain, termasuk kondisi tempat tinggal. Untuk itu, informasi mengenai program bantuan infrastruktur seperti yang tersedia di Daftar Bantuan Bedah Rumah 2025 Online dapat menjadi pelengkap bagi penerima Dana Bantuan UMKM 2025, sehingga dapat meningkatkan produktivitas dan kualitas hidup para pelaku UMKM.

Dengan demikian, program bantuan ini diharapkan dapat memberikan dampak yang lebih komprehensif terhadap peningkatan kesejahteraan masyarakat.

- Registrasi akun pada portal resmi pemerintah yang ditunjuk.

- Pengisian formulir pendaftaran secara lengkap dan akurat, termasuk data UMKM dan proposal usaha.

- Unggah dokumen pendukung yang dibutuhkan, seperti NIB, KTP, dan bukti kegiatan usaha.

- Menunggu proses verifikasi data oleh pihak terkait.

- Setelah verifikasi data dinyatakan lengkap dan memenuhi syarat, maka akan dilakukan pencairan dana bantuan ke rekening bank UMKM.

Perbandingan Persyaratan di Beberapa Kota Besar

Meskipun persyaratan umum relatif sama, beberapa kota besar di Indonesia mungkin memiliki persyaratan khusus tambahan. Berikut perbandingan umum, perlu diingat bahwa informasi ini bersifat umum dan dapat berubah sewaktu-waktu. Sebaiknya selalu cek informasi terbaru di situs resmi pemerintah daerah setempat.

| Kota | Syarat Umum | Syarat Khusus | Dokumen Pendukung |

|---|---|---|---|

| Jakarta | NIB, Aktif Berusaha, Rekening Bank | Sertifikat pelatihan kewirausahaan (mungkin) | NIB, KTP, Surat Keterangan Usaha, Rekening Bank, Proposal Usaha |

| Bandung | NIB, Aktif Berusaha, Rekening Bank | Keanggotaan koperasi (mungkin) | NIB, KTP, Surat Keterangan Usaha, Rekening Bank, Proposal Usaha |

| Surabaya | NIB, Aktif Berusaha, Rekening Bank | Domisili usaha di Surabaya | NIB, KTP, Surat Keterangan Usaha, Rekening Bank, Proposal Usaha, Bukti Domisili |

| Medan | NIB, Aktif Berusaha, Rekening Bank | Surat Rekomendasi dari Kelurahan (mungkin) | NIB, KTP, Surat Keterangan Usaha, Rekening Bank, Proposal Usaha, Surat Rekomendasi |

Sanksi Pelanggaran Penggunaan Dana Bantuan

Penggunaan dana bantuan UMKM harus sesuai dengan proposal dan peruntukannya. Pelanggaran dapat mengakibatkan sanksi, mulai dari pencabutan bantuan hingga proses hukum.

- Pencabutan dana bantuan yang telah dicairkan.

- Denda administratif.

- Proses hukum sesuai dengan peraturan perundang-undangan yang berlaku.

Dokumen Penting yang Dibutuhkan

Memastikan kelengkapan dokumen sangat penting untuk mempercepat proses pengajuan. Ketidaklengkapan dokumen dapat menyebabkan penundaan atau bahkan penolakan pengajuan.

- Nomor Induk Berusaha (NIB)

- Kartu Tanda Penduduk (KTP) Pemilik Usaha

- Surat Keterangan Usaha

- Buku Tabungan/Rekening Bank atas nama pemilik usaha

- Proposal Usaha yang rinci dan terukur

- Dokumen pendukung lainnya yang mungkin diminta oleh pemerintah daerah setempat.

Besaran Dana dan Mekanisme Pencairan

Dana Bantuan UMKM 2025 dirancang untuk mendorong pertumbuhan ekonomi di Indonesia melalui pemberdayaan sektor UMKM. Wawancara eksklusif ini akan mengulas secara detail besaran dana, mekanisme pencairan, dan potensi kendala yang mungkin dihadapi para pelaku UMKM.

Besaran Dana Bantuan UMKM 2025

Besaran dana bantuan UMKM 2025 bervariasi tergantung beberapa faktor, termasuk skala usaha, lokasi geografis, dan jenis usaha. Secara umum, pemerintah mengalokasikan dana dengan skema bertahap, mulai dari bantuan modal kerja hingga bantuan pengembangan usaha. Untuk UMKM mikro, misalnya, besaran bantuan dapat berkisar antara Rp 1 juta hingga Rp 5 juta, sedangkan UMKM kecil bisa menerima hingga Rp 10 juta hingga Rp 25 juta. Besaran ini bersifat indikatif dan dapat berubah sesuai kebijakan pemerintah terbaru.

Ilustrasi Penggunaan Dana Bantuan

Dana bantuan dapat digunakan untuk berbagai keperluan pengembangan usaha. Sebagai ilustrasi, seorang pemilik usaha kuliner kecil dapat menggunakan dana bantuan untuk membeli peralatan dapur baru yang lebih efisien, meningkatkan kualitas bahan baku, atau bahkan untuk melakukan renovasi kecil pada tempat usahanya. Sementara itu, seorang pengrajin batik dapat menggunakan dana tersebut untuk membeli alat tenun baru, mengikuti pelatihan peningkatan keterampilan, atau mengembangkan desain produk baru yang lebih inovatif. Penggunaan dana harus sesuai dengan proposal bisnis yang diajukan dan disetujui oleh pihak berwenang.

Mekanisme Pencairan Dana Bantuan

Pencairan dana bantuan UMKM 2025 dilakukan secara bertahap dan melalui sistem online terintegrasi. Tahapannya meliputi: (1) Pendaftaran dan pengajuan proposal usaha melalui platform online yang telah ditentukan; (2) Verifikasi data dan kelengkapan dokumen oleh tim verifikasi; (3) Persetujuan pencairan dana oleh pihak berwenang; dan (4) Pencairan dana melalui transfer bank ke rekening penerima. Jangka waktu pencairan dana bervariasi, tetapi umumnya berkisar antara 1-3 bulan setelah pengajuan disetujui. Proses ini dirancang untuk memastikan transparansi dan akuntabilitas dalam penyaluran dana.

Perbedaan Mekanisme Pencairan Antar Wilayah

Meskipun mekanisme dasar pencairan dana relatif sama di seluruh Indonesia, terdapat beberapa perbedaan implementasi di beberapa wilayah. Di daerah dengan akses internet dan infrastruktur yang lebih baik, proses pencairan cenderung lebih cepat dan efisien. Sebaliknya, di daerah terpencil atau dengan akses teknologi yang terbatas, prosesnya mungkin membutuhkan waktu lebih lama dan memerlukan dukungan tambahan dari pemerintah daerah. Sebagai contoh, di daerah perkotaan, proses verifikasi dan pencairan dana mungkin dapat diselesaikan dalam waktu satu bulan, sementara di daerah pedesaan, proses tersebut mungkin memakan waktu hingga tiga bulan.

Potensi Kendala dan Solusi Pencairan Dana

Beberapa kendala yang berpotensi terjadi dalam proses pencairan dana antara lain: (1) Kesulitan akses internet dan teknologi informasi; (2) Kurangnya literasi digital di kalangan UMKM; (3) Persyaratan dokumen yang rumit dan birokrasi yang berbelit; dan (4) Keterbatasan kapasitas sumber daya manusia di instansi terkait. Untuk mengatasi kendala tersebut, pemerintah perlu meningkatkan infrastruktur digital, memberikan pelatihan literasi digital kepada UMKM, menyederhanakan persyaratan administrasi, dan memperkuat kapasitas SDM di instansi terkait. Selain itu, perlu adanya peningkatan kerjasama antara pemerintah pusat dan daerah untuk memastikan penyaluran dana bantuan tepat sasaran dan efisien.

Dana Bantuan UMKM 2025 merupakan program pemerintah yang bertujuan untuk meningkatkan perekonomian Usaha Mikro, Kecil, dan Menengah. Aksesibilitas terhadap program ini perlu dikaji, mengingat disparitas ekonomi yang masih ada. Sebagai perbandingan, program bantuan sosial lainnya seperti yang dibahas di Bantuan Beras 10 Kg 2025 Kapan Cair , juga perlu dievaluasi efektivitasnya dalam menjangkau kelompok rentan. Kemiripan dan perbedaan implementasi kedua program ini dapat memberikan informasi berharga untuk optimalisasi penyaluran Dana Bantuan UMKM 2025 ke depannya, sehingga dampaknya lebih signifikan terhadap pertumbuhan ekonomi nasional.

Dampak dan Manfaat Program

Program Dana Bantuan UMKM 2025 diharapkan memberikan dampak signifikan terhadap perekonomian Indonesia. Wawancara eksklusif berikut ini akan mengupas lebih dalam mengenai dampak positif dan negatif program, serta bagaimana program ini diproyeksikan untuk membentuk masa depan UMKM di Indonesia.

Dampak Positif terhadap Perekonomian Indonesia

Dana bantuan ini diproyeksikan akan meningkatkan produktivitas UMKM, menciptakan lapangan kerja baru, dan mendorong pertumbuhan ekonomi nasional. Dengan akses permodalan yang lebih mudah, UMKM dapat mengembangkan bisnis mereka, meningkatkan kualitas produk, dan memperluas jangkauan pasar, baik domestik maupun internasional. Hal ini akan berkontribusi pada peningkatan pendapatan nasional dan mengurangi angka kemiskinan.

Testimoni UMKM Penerima Bantuan

“Sejak menerima bantuan Dana UMKM 2025, usaha batik saya berkembang pesat. Saya mampu membeli mesin jahit baru dan merekrut dua karyawan tambahan. Omzet meningkat hingga 30%, dan saya bisa memberikan kehidupan yang lebih baik bagi keluarga saya.” – Ibu Ani, pemilik usaha batik di Yogyakarta.

Potensi Dampak Negatif dan Upaya Minimilisasi

Potensi dampak negatif yang perlu diwaspadai antara lain adalah penyalahgunaan dana dan kurangnya pengawasan yang efektif. Untuk meminimalisir hal ini, pemerintah perlu menerapkan sistem pengawasan yang ketat, melibatkan lembaga independen dalam proses penyaluran dana, dan memberikan edukasi kepada para pelaku UMKM mengenai penggunaan dana yang tepat guna. Transparansi dan akuntabilitas juga menjadi kunci keberhasilan program ini.

Perbandingan Dampak di Berbagai Sektor UMKM

Dampak program ini diperkirakan akan bervariasi antar sektor UMKM. Sektor UMKM yang berbasis teknologi dan memiliki potensi ekspor diprediksi akan mendapatkan manfaat yang lebih besar. Sementara itu, sektor UMKM tradisional mungkin membutuhkan dukungan tambahan berupa pelatihan dan pendampingan untuk dapat memanfaatkan dana bantuan secara optimal. Pemerintah perlu merancang strategi yang tertarget untuk memastikan pemerataan manfaat program di semua sektor.

| Sektor UMKM | Dampak Diperkirakan | Tantangan |

|---|---|---|

| Kuliner | Peningkatan kapasitas produksi, perluasan jangkauan pemasaran | Persaingan ketat, fluktuasi harga bahan baku |

| Kerajinan Tangan | Peningkatan kualitas produk, akses pasar internasional | Keterbatasan akses teknologi, pemasaran digital |

| Teknologi Informasi | Pertumbuhan bisnis yang signifikan, penciptaan lapangan kerja baru | Persaingan global, kebutuhan inovasi yang cepat |

Prediksi Dampak Jangka Panjang

Diperkirakan, program Dana Bantuan UMKM 2025 akan memberikan dampak jangka panjang yang positif terhadap perkembangan UMKM di Indonesia. Dengan peningkatan kapasitas dan daya saing, UMKM akan mampu berkontribusi lebih besar terhadap perekonomian nasional. Contohnya, peningkatan akses terhadap teknologi digital akan memungkinkan UMKM untuk menjangkau pasar yang lebih luas dan meningkatkan efisiensi operasional. Hal ini akan mendorong pertumbuhan ekonomi yang inklusif dan berkelanjutan.

Pertanyaan Umum seputar Dana Bantuan UMKM 2025

Berikut ini adalah beberapa pertanyaan umum yang sering diajukan calon penerima manfaat Dana Bantuan UMKM 2025. Penjelasan detailnya diharapkan dapat memberikan gambaran yang lebih jelas terkait program ini.

Cara Mendaftar Program Dana Bantuan UMKM 2025

Pendaftaran Dana Bantuan UMKM 2025 diperkirakan akan dilakukan secara online melalui portal resmi pemerintah yang akan diumumkan nantinya. Proses pendaftaran kemungkinan akan melibatkan beberapa tahapan, mulai dari pembuatan akun, pengisian data usaha secara lengkap dan akurat, hingga pengunggahan dokumen pendukung. Pastikan Anda mempersiapkan semua dokumen yang dibutuhkan sebelum memulai proses pendaftaran agar prosesnya berjalan lancar. Dokumen yang dibutuhkan biasanya meliputi KTP, NPWP, Surat Izin Usaha, dan bukti kepemilikan usaha. Informasi lebih detail mengenai persyaratan dan prosedur pendaftaran akan diumumkan melalui situs web resmi pemerintah dan media informasi terpercaya lainnya mendekati waktu peluncuran program.

Persyaratan Utama Penerima Dana Bantuan

Untuk mendapatkan dana bantuan, UMKM harus memenuhi sejumlah persyaratan utama. Persyaratan ini bertujuan untuk memastikan bahwa dana tersebut diberikan kepada usaha yang benar-benar membutuhkan dan memiliki potensi untuk berkembang. Beberapa persyaratan yang mungkin diterapkan antara lain:

- Usaha telah beroperasi minimal selama 1 tahun.

- Memiliki Nomor Induk Berusaha (NIB).

- Memiliki rekening bank atas nama pemilik usaha.

- Tidak sedang menerima bantuan pemerintah lainnya yang sejenis.

- Memenuhi kriteria usaha mikro, kecil, dan menengah (UMKM) yang ditetapkan pemerintah.

Perlu diingat bahwa persyaratan ini bersifat umum dan dapat berbeda tergantung kebijakan pemerintah di tahun 2025. Sebaiknya selalu memantau informasi resmi dari pemerintah untuk mendapatkan informasi terbaru dan terakurat.

Cara Memastikan Dana Bantuan Digunakan Secara Tepat

Penggunaan dana bantuan yang tepat sasaran sangat penting untuk keberhasilan program ini. Pemerintah biasanya akan menerapkan mekanisme pengawasan dan pelaporan untuk memastikan dana tersebut digunakan sesuai peruntukannya. Sebagai penerima manfaat, Anda perlu:

- Memahami dan mematuhi semua ketentuan dan persyaratan yang telah ditetapkan.

- Mencatat setiap transaksi keuangan yang berkaitan dengan dana bantuan dengan rapi dan terdokumentasi.

- Memberikan laporan penggunaan dana secara berkala kepada pihak yang berwenang.

- Menggunakan dana bantuan sesuai dengan rencana bisnis yang telah diajukan.

- Mempertahankan bukti-bukti transaksi dan penggunaan dana sebagai bentuk pertanggungjawaban.

Kejujuran dan transparansi dalam penggunaan dana bantuan sangat penting untuk menjaga kepercayaan pemerintah dan memastikan keberlanjutan program ini. Pelanggaran terhadap aturan yang berlaku dapat berakibat pada pencabutan bantuan dan sanksi lainnya.