Forex vs Crypto di Tahun 2025: A Right Proper Look-See

Forex Vs Crypto 2025 – Right, so 2024’s been a bit of a rollercoaster, innit? Forex, the OG of trading, saw some pretty standard swings, influenced by, you know, global events – inflation, interest rates, all that jazz. Crypto, on the other hand? Well, that was a whole different kettle of fish. We saw some mega pumps and dumps, plenty of drama with regulations, and a few dodgy projects biting the dust. Let’s dive into what’s shaping up for 2025.

Major trends affecting both markets include increased regulatory scrutiny (especially for crypto), the ongoing impact of global economic uncertainty, and the ever-growing adoption of digital assets. Tech advancements, like DeFi and Web3, are also major players, particularly in the crypto space. It’s all a bit of a vibe, really.

Memilih antara Forex dan Crypto di tahun 2025 memang menantang. Keduanya menawarkan potensi keuntungan besar, namun juga risiko yang sama besarnya. Jika Anda tertarik dengan dunia Forex dan ingin memulai perjalanan investasi Anda, langkah pertama adalah membuka akun. Pelajari lebih lanjut caranya dengan mengunjungi panduan lengkap di Cara Buka Akun Forex 2025. Setelah memahami prosesnya, Anda dapat kembali menganalisis mana yang lebih sesuai dengan profil risiko dan tujuan investasi Anda di pasar Forex vs Crypto 2025.

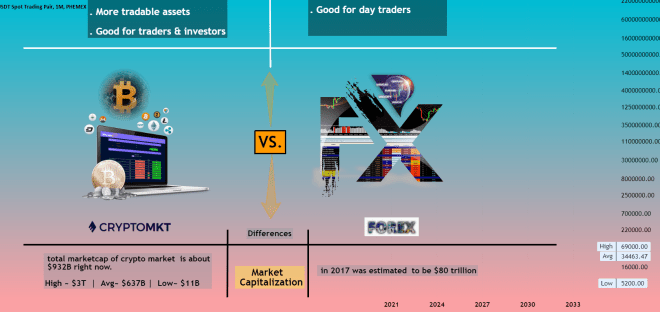

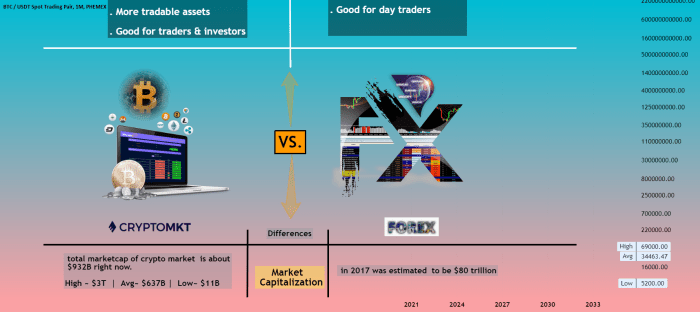

Perbandingan Forex dan Crypto: Volatilitas, Regulasi, dan Aksesibilitas

Forex and crypto are like chalk and cheese, mate. Forex is generally considered less volatile than crypto, although it still has its moments. Regulation is pretty established in Forex, but crypto? Still finding its feet, with rules varying wildly across different jurisdictions. Access to Forex is generally easier, but crypto is becoming more accessible thanks to user-friendly platforms and apps.

Memilih antara Forex dan Crypto di tahun 2025 memang menantang. Pertimbangan matang diperlukan sebelum terjun ke dunia investasi yang penuh dinamika ini. Untuk membantu perencanaan trading Forex Anda, manfaatkanlah Kalkulator Trading Forex 2025 yang akurat dan mudah digunakan. Dengan perencanaan yang baik, Anda dapat meminimalisir risiko dan memaksimalkan peluang sukses, baik di pasar Forex maupun Crypto di masa depan.

Semoga pilihan investasi Anda bijak dan membawa hasil yang memuaskan.

Potensi Pertumbuhan Forex dan Crypto Hingga 2025

Predicting the future is a bit of a mug’s game, but based on current trends, Forex is expected to see steady, if not spectacular, growth. Think slow and steady wins the race. Crypto, however, could experience explosive growth if certain factors align – wider adoption, clearer regulations, and successful integration into mainstream finance. It’s a high-risk, high-reward situation, innit?

Memilih antara Forex dan Crypto di tahun 2025 memang dilema. Perbedaan keduanya cukup signifikan, terutama dalam cara kerjanya. Untuk memahami lebih dalam Forex, baca selengkapnya tentang Cara Kerja Forex 2025 agar Anda bisa membandingkan dengan mekanisme Crypto. Dengan pemahaman yang baik, Anda dapat membuat keputusan investasi yang tepat sesuai dengan profil risiko dan tujuan finansial Anda di tengah persaingan Forex Vs Crypto 2025.

Tabel Perbandingan Forex dan Crypto

| Aspek | Forex | Crypto |

|---|---|---|

| Volatilitas | Relatif Rendah | Relatif Tinggi |

| Regulasi | Teratur | Sedang Berkembang |

| Aksesibilitas | Mudah | Semakin Mudah |

Analisis Pasar Forex di Tahun 2025

Right, so 2025 in Forex? It’s gonna be a proper rollercoaster, innit? Predicting the future’s a bit of a dodgy business, but based on current trends and a bit of educated guesswork, here’s what we might see. Think of this as a vibe check, not a crystal ball, alright?

Pergerakan Pasangan Mata Uang Utama di Tahun 2025

Predicting specific numbers is, like, impossible. But we can get a feel for the general direction. Think of it like this: the EUR/USD could see some serious swings, possibly ranging between 1.05 and 1.20, depending on how things pan out with the Eurozone economy. The USD/JPY, always a bit of a wild card, might see a rise due to potential interest rate hikes in the US, potentially reaching 145 or even higher. The GBP/USD? Well, that’s a whole other kettle of fish. Brexit’s still causing ripples, so expect some volatility, maybe bouncing between 1.15 and 1.30. It’s all a bit of a gamble, really.

Pengaruh Kebijakan Moneter Bank Sentral Utama, Forex Vs Crypto 2025

Central banks, they’re the big players, yeah? Their monetary policies will massively impact the Forex market. If the US Federal Reserve keeps hiking interest rates to combat inflation, that’ll strengthen the dollar, making other currencies look a bit weak. Conversely, if the European Central Bank takes a more dovish approach, the euro might struggle. It’s all about the relative strength of these economies and how central banks manage things. It’s a proper game of chess, this one.

Faktor Geopolitik yang Berpotensi Mempengaruhi Pasar Forex

Geopolitics? Massive impact. Think about it: international tensions, trade wars, political instability – all these things can send the markets into a frenzy. A major geopolitical event could easily cause significant fluctuations in currency pairs. For example, escalating tensions in Eastern Europe could see safe-haven currencies like the Japanese yen or Swiss franc strengthen, while riskier currencies might take a dive. It’s all a bit of a minefield, to be honest.

Potensi Dampak Inflasi Global terhadap Pasar Forex

Inflation, mate, it’s a proper beast. High inflation in one country will likely weaken its currency relative to others with lower inflation. If inflation globally stays high, we could see significant shifts in currency values as investors seek higher returns in countries with stronger currencies. It’s a bit of a balancing act, trying to find the best place to park your money.

Ilustrasi Grafik Pergerakan Harga EUR/USD di Tahun 2025

Imagine a graph. The x-axis represents time throughout 2025, and the y-axis represents the EUR/USD exchange rate. The line starts around 1.10 at the beginning of the year. During the first quarter, it shows a gradual increase, peaking around 1.15 in April due to positive economic news from the Eurozone. Then, there’s a slight dip in the second quarter due to global uncertainty, falling back to 1.12. The third quarter shows a more volatile period, with fluctuations between 1.10 and 1.18, reflecting the impact of various geopolitical events and central bank decisions. By the end of the year, it settles around 1.16, indicating a generally positive outlook for the Euro against the dollar, but with some serious bumps along the way. It’s all a bit unpredictable, though, innit?

Memilih antara Forex dan Crypto di tahun 2025 memang dilema. Keduanya menawarkan potensi keuntungan besar, namun risiko juga sama besarnya. Untuk trading Forex yang konsisten, keandalan koneksi internet sangat penting. Oleh karena itu, investasi pada VPS berkualitas tinggi sangat krusial, seperti yang ditawarkan di Vps Untuk Trading Forex 2025. Dengan VPS yang handal, Anda bisa fokus mengoptimalkan strategi trading Forex Anda, dan membuat keputusan tepat dalam pertarungan Forex vs Crypto di masa depan.

Semoga pilihan Anda bijak dan menguntungkan!

Analisis Pasar Crypto di Tahun 2025: Forex Vs Crypto 2025

Right, so 2025, eh? Crypto’s gonna be a proper rollercoaster, innit? Predicting the future’s a bit of a dodgy game, but let’s have a crack at figuring out what might be happening in the cryptoverse in a few years’ time. We’ll be looking at Bitcoin’s price, some top altcoins, the tech shaping things up, the legal stuff, and how big banks might get involved. Basically, the whole shebang.

Memilih antara Forex dan Crypto di tahun 2025 memang dilema. Kedua pasar menawarkan potensi keuntungan besar, namun juga risiko yang sama besarnya. Untuk berinvestasi di Forex, memahami jadwal perdagangan sangat penting, karena itu, cek dulu Jam Buka Market Forex 2025 sebelum memulai. Informasi ini krusial dalam strategi investasi Forex Anda, membantu Anda mengambil keputusan tepat di tengah persaingan Forex vs Crypto 2025 yang dinamis.

Prediksi Harga Bitcoin dan Altcoin Utama di Tahun 2025

Predicting prices is, like, totally impossible, but based on current trends and previous cycles, we can make some educated guesses. Bitcoin might be chilling around a hefty sum, maybe somewhere in the six figures, depending on adoption rates and overall market sentiment. Altcoins, well, that’s a whole different kettle of fish. Some might absolutely smash it, while others might become, well, completely irrelevant. Think of it like a game of musical chairs – some will grab a seat, others will be left standing. Ethereum, being the OG smart contract platform, is likely to remain a major player. However, new competitors are always popping up, so it’s all about keeping your eyes peeled and your wits about you.

Teknologi Blockchain yang Berpotensi Mempengaruhi Pasar Crypto

The tech side of things is buzzing, bruv. Layer-2 scaling solutions are going to be massive – think faster transactions and lower fees, making crypto more usable for the everyday person. Improvements in privacy tech, like zero-knowledge proofs, will also be key, addressing some of the current concerns around anonymity and data security. Furthermore, the integration of blockchain with other technologies like AI and the metaverse is going to be a game-changer, opening up a whole load of new possibilities.

Memilih antara Forex dan Crypto di tahun 2025 memang menantang. Pertimbangan matang sangat dibutuhkan sebelum terjun ke dunia investasi yang penuh dinamika ini. Untuk membantu perhitungan profit dan kerugian di pasar Forex, manfaatkanlah Kalkulator Forex Pips 2025 yang akurat dan mudah digunakan. Dengan perencanaan yang baik dan alat bantu yang tepat, Anda dapat melangkah lebih percaya diri dalam menghadapi persaingan Forex Vs Crypto di masa depan.

Semoga keputusan investasi Anda bijak dan menguntungkan.

- Layer-2 scaling solutions (e.g., Polygon, Arbitrum): These will drastically improve transaction speeds and reduce costs.

- Improved privacy technologies (e.g., ZK-SNARKs): Enhancing user privacy and security will be crucial for wider adoption.

- Blockchain integration with AI and the metaverse: This fusion will unlock innovative applications and use cases.

Regulasi Crypto di Berbagai Negara dan Dampaknya pada Pasar

Right, the legal side of things is a bit of a minefield. Different countries are taking wildly different approaches to regulating crypto. Some are embracing it with open arms, while others are, like, super cautious. This regulatory landscape is going to have a massive impact on the market, affecting everything from investment flows to the development of new projects. A clear and consistent global regulatory framework is needed to ensure stability and prevent dodgy dealings.

Potensi Adopsi Crypto oleh Institusi Keuangan Besar

Big banks and financial institutions are starting to take notice, mate. Some are already dipping their toes into the crypto waters, experimenting with blockchain technology and offering crypto-related services. As crypto becomes more mainstream and regulation becomes clearer, we can expect to see even greater institutional adoption in the coming years. This will bring more stability and legitimacy to the market, attracting more investors and driving further growth.

Memilih antara Forex dan Crypto di tahun 2025 memang menantang. Kedua pasar menawarkan potensi keuntungan besar, namun juga risiko yang sama besarnya. Jika Anda tertarik dengan dunia Forex dan ingin memulai perjalanan investasi Anda, sangat penting untuk memilih broker yang terpercaya. Untuk itu, silahkan cek Daftar Broker Forex Terbaik Di Indonesia 2025 untuk membantu Anda membuat keputusan yang bijak.

Dengan memilih broker yang tepat, Anda dapat meminimalisir risiko dan memaksimalkan peluang sukses dalam pasar Forex, yang tentu saja akan sangat membantu Anda dalam pertimbangan Forex vs Crypto 2025.

Risiko dan Peluang Investasi di Pasar Crypto pada Tahun 2025

Volatility remains a significant risk, and regulatory uncertainty could impact market sentiment. However, the potential for substantial returns, coupled with the increasing adoption of blockchain technology across various sectors, presents significant opportunities for investors who understand the risks and conduct thorough due diligence. It’s a high-risk, high-reward game, basically.

Perbandingan Forex vs Crypto di Tahun 2025

Right, so 2025 – a bit of a crystal ball gazing sesh here, innit? Predicting the future of Forex and Crypto is a proper gamble, but let’s have a crack at comparing these two beasts. We’ll look at their historical returns, risk levels, liquidity, and transaction costs. Think of it as a head-to-head, a proper showdown between the old guard and the new kid on the block.

Return Investasi Historis Forex dan Crypto

Historically, Forex has shown more stable, albeit often smaller, returns compared to crypto. Crypto’s volatility is legendary – think rollercoaster rides with massive gains and equally massive losses. While some cryptos have delivered insane returns, others have completely tanked. Forex, on the other hand, tends to be a bit more predictable, with smaller, steadier gains (or losses). It’s a bit like comparing a steady marathon runner to a sprinter who might win big or crash and burn.

Tingkat Risiko Investasi Forex dan Crypto

Risk is the name of the game, mate. Crypto is, without a doubt, the higher-risk option. The market is incredibly volatile, influenced by everything from tweets to regulatory changes. Forex is riskier than a savings account, sure, but generally less volatile than crypto. Diversification and proper risk management are crucial in both, but especially in crypto. Think of it this way: Forex is like a slightly bumpy car ride, while crypto is a rollercoaster that might chuck you out.

Likuiditas Pasar Forex dan Crypto

Forex boasts mind-blowing liquidity. It’s the biggest market globally, meaning you can get in and out of trades super quickly. Crypto is catching up, but it’s still not quite there yet. Certain cryptos have decent liquidity, but others can be a nightmare to trade, with massive slippage and wide spreads. Liquidity is key, especially if you need to get out of a position quickly. Forex is the undisputed champ in this arena.

Biaya Transaksi Forex dan Crypto

Transaction costs vary, but generally, Forex brokers charge lower fees than many crypto exchanges. Crypto exchanges can sometimes have hefty fees, especially for smaller trades. However, some decentralised exchanges (DEXs) are trying to disrupt this, offering lower fees. It’s worth shopping around, for both Forex and Crypto, to find the best deals. Always check the small print, though – those hidden fees can sting.

Tabel Perbandingan Forex vs Crypto

| Kriteria | Forex | Crypto |

|---|---|---|

| Return Investasi Historis | Relatif stabil, return lebih kecil | Sangat volatile, potensi return tinggi dan rendah |

| Tingkat Risiko | Sedang | Tinggi |

| Likuiditas | Sangat Tinggi | Sedang (meningkat) |

| Biaya Transaksi | Relatif rendah | Bervariasi, bisa tinggi |

Strategi Investasi di Forex dan Crypto untuk Tahun 2025

Right, so 2025 is looming, innit? Investing in Forex and Crypto can be a proper rollercoaster, but with a bit of savvy planning, you can hopefully dodge some of the major crashes and bag some serious gains. This ain’t financial advice, obviously, but here’s a lowdown on some strategies for both the cautious and the thrill-seekers.

Strategi Investasi Konservatif di Pasar Forex

For those who prefer a more chilled approach, Forex offers some decent options for steady growth. Think of it like a long, slow climb up a hill – less dramatic, but still rewarding in the end.

- Carry Trade: Borrowing money in a low-interest-rate currency and investing it in a high-interest-rate currency. It’s a classic, but you need to be aware of exchange rate fluctuations.

- Trend Following: Identifying long-term trends and riding them. This requires patience and a good understanding of market analysis. Don’t jump in on a whim!

- Diversified Portfolio: Don’t put all your eggs in one basket, mate. Spread your investments across different currency pairs to reduce risk. Think of it like having backup plans – always a good idea.

Strategi Investasi Agresif di Pasar Crypto

Now, for the adrenaline junkies, Crypto is where it’s at. High risk, high reward – that’s the motto. But remember, it’s a wild ride, so buckle up.

- Day Trading: Buying and selling cryptocurrencies within the same day to capitalize on short-term price swings. It’s high-octane stuff, and not for the faint of heart. You need to be on the ball, constantly monitoring the market.

- Swing Trading: Holding cryptocurrencies for a few days or weeks to profit from price fluctuations. A bit less frantic than day trading, but still needs sharp market awareness.

- Investing in Emerging Projects: Backing up-and-coming crypto projects can lead to massive returns, but it’s a huge gamble. Think of it like backing a new band – some become massive, others… well, not so much.

Pentingnya Diversifikasi Portofolio Investasi

Regardless of whether you’re a Forex whiz or a Crypto king, diversifying your portfolio is absolute key. Don’t put all your eggs in one basket. Spreading your investments across different asset classes and markets reduces your overall risk. Imagine having a few different income streams – if one dries up, you’ve still got others to fall back on.

Pengelolaan Risiko untuk Investasi di Kedua Pasar

Risk management is crucial, whether you’re chilling with Forex or going wild with Crypto. It’s about protecting your hard-earned cash.

- Set Stop-Loss Orders: These automatically sell your assets if the price drops below a certain level, limiting potential losses.

- Only Invest What You Can Afford to Lose: This is the golden rule, innit? Don’t invest money you need for rent or food.

- Do Your Research: Don’t just jump in blindly. Understand the risks involved before investing in anything.

Tips untuk Investor Pemula di Pasar Forex dan Crypto

So, you’re thinking of dipping your toes in? Here’s some advice to help you navigate the choppy waters.

- Start Small: Don’t go all in straight away. Begin with a small amount to get a feel for the markets.

- Learn the Basics: Educate yourself before you invest. There are tons of resources available online.

- Be Patient: Investing takes time. Don’t expect to get rich quick.

- Stay Updated: Keep an eye on market trends and news.

- Don’t Panic Sell: Market fluctuations are normal. Don’t make rash decisions based on short-term dips.

Pertanyaan Umum (FAQ)

Right, so you’re buzzing to know more about Forex versus Crypto in 2025? No worries, mate, let’s crack on with some FAQs. We’ll keep it brief and to the point, no messing about.

Perbandingan Keamanan Investasi Forex dan Crypto

Honestly, it’s a bit of a minefield. Forex is generally considered a bit more stable, like a comfy armchair compared to a rollercoaster. It’s regulated in many places, meaning there are rules and safeguards in place. Crypto, on the other hand, is the wild west – super volatile, and less regulated. Think of it like this: Forex is a bit like investing in a solid, established company, while crypto is more like backing a brand-new startup. One could skyrocket, the other could totally flop. There’s always a risk involved, obviously.

Memulai Investasi Forex dan Crypto

Getting started isn’t rocket science, but it does need a bit of savvy. For Forex, you’ll need a broker – think of them as your middleman. You’ll need to open an account, deposit some dosh, and then you can start trading currency pairs. For Crypto, you’ll need a crypto exchange, like Coinbase or Binance. You create an account, verify your identity (a bit of a faff, but necessary), and then you can buy, sell, and trade various cryptos. Remember to do your research, though – don’t just jump in headfirst.

- Forex: Find a reputable broker, open an account, fund it, learn the basics of trading, and start small.

- Crypto: Choose a secure exchange, verify your identity, research different cryptocurrencies, and start with a small investment.

Risiko Investasi Forex dan Crypto

Alright, let’s talk risks. Both Forex and Crypto carry significant risks. In Forex, you could lose your entire investment if you make bad trades or the market moves against you. Leverage can amplify both profits and losses – that’s a bit of a double-edged sword. With Crypto, the volatility is insane. The price can swing wildly in short periods, leading to massive gains or equally massive losses. Scams and hacks are also a major concern in the crypto world. Diversification and risk management are key – don’t put all your eggs in one basket.

Perbedaan Utama Trading Forex dan Crypto

The main difference? Forex trades currencies, while Crypto trades digital assets. Forex is generally more regulated, while Crypto is the wild west. Forex markets are open 24/5, while Crypto markets are pretty much always open. Forex trading involves larger sums of money usually, while crypto can be accessed with smaller amounts.

| Feature | Forex | Crypto |

|---|---|---|

| Assets Traded | Currencies | Digital Assets |

| Regulation | Generally Higher | Generally Lower |

| Volatility | Lower (Generally) | Higher (Generally) |

| Market Hours | 24/5 | 24/7 |

Memilih Platform Trading yang Tepat

Choosing the right platform is crucial, innit? For Forex, look for a platform with tight spreads (the difference between the buy and sell price), good execution speeds, and a user-friendly interface. For Crypto, security is paramount. Look for exchanges with strong security measures, a good reputation, and a wide range of supported cryptocurrencies. Do your research and read reviews before committing.

- Forex: Consider platforms like MetaTrader 4 or 5, cTrader.

- Crypto: Explore exchanges like Coinbase, Binance, Kraken.