Analisis SWOT Koperasi Simpan Pinjam 2025

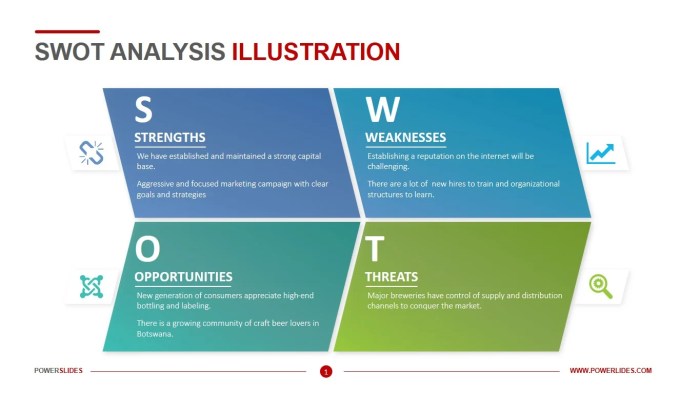

Analisis Swot Koperasi Simpan Pinjam 2025 – Yo, peeps! The future’s lookin’ kinda cray-cray, especially for Indonesian cooperatives. With the digital age totally blowing up, it’s crucial for these simpan pinjam (savings and loan) co-ops to stay ahead of the curve. This SWOT analysis is all about figuring out how they can totally *slay* in 2025 and beyond. We’re gonna break down the good, the bad, and the downright ugly, so buckle up, buttercup!

Dampak Perkembangan Teknologi dan Ekonomi Digital terhadap Koperasi Simpan Pinjam

Digital disruption is real, y’all. Fintech apps are popping up like crazy, offering super-convenient services that traditional co-ops might struggle to match. Think super-fast loans, easy online transactions, and 24/7 access – that’s a whole lotta competition for the old-school co-ops. On the flip side, these digital tools can also be a total game-changer for co-ops. They can use tech to reach more members, streamline operations, and even offer new, innovative financial products. It’s a double-edged sword, for sure.

Kondisi Koperasi Simpan Pinjam di Indonesia Saat Ini

Right now, the Indonesian simpan pinjam landscape is a mixed bag. Some co-ops are thriving, while others are struggling to keep up. Many are still relying on traditional methods, which can be slow and inefficient. There’s a huge gap between the tech-savvy co-ops and those that are lagging behind. This disparity creates both opportunities and challenges for the future.

Tren Terkini yang Memengaruhi Sektor Koperasi Simpan Pinjam

The vibe is shifting, fam. Here’s what’s shaping the future of Indonesian simpan pinjam co-ops:

- Financial Inclusion: More and more people are getting access to financial services, which is a huge opportunity for co-ops to expand their reach.

- Digitalization: This is a major trend, with co-ops needing to adapt to survive. Think online banking, mobile payments, and AI-powered services.

- Government Regulations: New rules and regulations are constantly changing the game. Co-ops need to stay on top of these changes to avoid any major pitfalls.

- Competition: Fintech companies are major players now, and co-ops need to find ways to compete effectively.

Tantangan dan Peluang Koperasi Simpan Pinjam di Masa Depan

Look, it’s not all sunshine and rainbows. Co-ops face some serious challenges, but there are also some major opportunities to grab.

| Tantangan | Peluang |

|---|---|

| Meningkatnya persaingan dari fintech | Ekspansi ke pasar yang belum terlayani |

| Adopsi teknologi yang lambat | Pengembangan produk dan layanan inovatif |

| Keterbatasan akses modal | Kemitraan strategis dengan lembaga keuangan lainnya |

| Kurangnya literasi keuangan di kalangan anggota | Program edukasi keuangan untuk meningkatkan pemahaman anggota |

Mengidentifikasi Strength (Kekuatan) Koperasi Simpan Pinjam

Yo, peeps! Let’s dive into what makes a successful credit union *totally* rock. We’re talking about identifying their strengths – the things that make them, like, *the bomb*. Think of it as their secret weapon in the financial game. We’ll break down their internal superpowers, compare them to the competition, and see how they can totally level up their game in 2025.

Menganalisis SWOT Koperasi Simpan Pinjam di tahun 2025 membutuhkan pemahaman mendalam tentang potensi dan tantangannya. Kita perlu melihat berbagai faktor, mulai dari tingkat literasi keuangan anggota hingga perkembangan teknologi. Sebagai perbandingan, bayangkan kompleksitas dunia bisnis game; pertanyaan seperti yang dibahas di Apakah Pubg Mobile Meminjam Dana Ke Garena Free Fire 2025 menunjukkan betapa rumitnya arus keuangan dalam skala yang berbeda.

Kembali ke analisis SWOT Koperasi Simpan Pinjam, perencanaan yang matang dan strategi yang tepat sangat krusial untuk keberhasilannya di masa depan. Dengan memahami potensi dan risiko, koperasi dapat tumbuh dan memberikan manfaat maksimal bagi anggotanya.

Analyzing a credit union’s strengths isn’t just about bragging rights; it’s about understanding their competitive advantage and how to use it to achieve their goals. It’s all about maximizing their potential, you know? It’s like having a killer strategy for a video game – you need to know your best moves to win!

Kekuatan Internal Koperasi Simpan Pinjam

Okay, so let’s get down to the nitty-gritty. What are some major internal strengths a credit union might have? Think of it like this: what are their killer apps? Their unique selling propositions (USPs)? Their “that’s what she said” moments (but in a good way, of course!)

- Solid Reputation: A credit union with a stellar reputation, like, *totally* builds trust. People are more likely to choose a credit union they know and love.

- Strong Management: A kickass management team can make or break a credit union. Think of them as the MVPs (Most Valuable Players) of the financial world.

- Member Loyalty: Loyal members are gold, dude. They’re the ones who keep the credit union afloat and thriving. They’re like your ride-or-die squad.

Perbandingan Kekuatan dengan Kompetitor

| Kekuatan | Kompetitor (Bank/Koperasi Lain) | Perbandingan |

|---|---|---|

| Reputasi yang sangat baik di komunitas lokal | Bank Nasional X: Reputasi luas, tetapi kurang personal | Koperasi lebih unggul dalam kepercayaan komunitas lokal, Bank X unggul dalam jangkauan nasional. |

| Manajemen yang efisien dan berpengalaman | Koperasi Y: Manajemen kurang berpengalaman | Koperasi memiliki keunggulan dalam manajemen yang teruji. |

| Tingkat loyalitas anggota yang tinggi | Bank Z: Tingkat churn (pergantian anggota) tinggi | Koperasi memiliki keunggulan dalam retensi anggota. |

Aset dan Sumber Daya Utama

Think of a credit union’s assets and resources as their secret stash. These are the things that give them a serious edge over the competition. These are the things that make them *lit*.

- Experienced Staff: A team of knowledgeable and experienced staff members is a major plus. They’re the ones who keep everything running smoothly.

- Strong Capital Base: A solid financial foundation is essential for any credit union. It’s like having a huge safety net.

- Advanced Technology: Using cutting-edge technology allows for efficient operations and better member services. Think online banking, mobile apps – all that jazz.

Keunggulan Kompetitif yang Dapat Dipertahankan

This is where it gets real. What makes this credit union stand out from the crowd and *stay* ahead of the game? What’s their *secret sauce*?

- Personalized Service: Many credit unions offer a more personalized approach than larger banks, building stronger member relationships.

- Community Focus: Credit unions often prioritize supporting their local communities, fostering a sense of belonging and loyalty.

- Competitive Interest Rates: Offering attractive interest rates on savings and loans can attract and retain members.

Pemanfaatan Kekuatan untuk Mencapai Tujuan Koperasi

Okay, so you’ve got all these awesome strengths. Now what? How do you use them to totally crush your goals? It’s all about strategic planning, my friend. It’s like having a game plan for ultimate victory!

- Marketing and Promotion: Highlight the credit union’s strong reputation and personalized service to attract new members.

- Member Engagement: Foster a strong sense of community and loyalty among members through events and communication.

- Innovation and Technology: Continuously improve services and offerings using new technologies to stay competitive.

Menganalisis Weakness (Kelemahan) Koperasi Simpan Pinjam

Yo, peeps! Let’s get real about the downsides of these credit unions. While they offer a totally rad way to save and borrow, they’re not without their flaws. Think of it like this: even the coolest skate park has some gnarly cracks in the concrete. We’re gonna spill the tea on some common weaknesses, and how these co-ops can totally level up their game in 2025.

Identifikasi Kelemahan Internal Koperasi Simpan Pinjam

Okay, so what’s holding these credit unions back? It’s a total bummer, but some common issues include limited tech access, a shortage of skilled peeps (aka, employees), and inefficient management systems. It’s like trying to run a marathon in flip-flops – not gonna happen, dude!

Analisis SWOT Koperasi Simpan Pinjam 2025 memperhatikan banyak faktor, termasuk daya saing suku bunga. Salah satu poin penting yang perlu dipertimbangkan adalah bagaimana strategi koperasi menghadapi persaingan, terutama terkait produk pinjaman. Memahami Bunga Pinjaman Rekening Koran 2025 menjadi krusial dalam analisis ini, karena memberikan gambaran tentang tren pasar dan potensi keuntungan atau kerugian bagi koperasi.

Dengan demikian, Analisis SWOT yang komprehensif harus memperhitungkan dinamika suku bunga ini untuk merumuskan strategi yang tepat dan berkelanjutan.

- Limited Technology Access: Many credit unions, especially smaller ones, are stuck in the past. They lack the snazzy apps and online banking features that their competitors boast, making it a total drag for members.

- Shortage of Skilled Personnel: Finding peeps who are both knowledgeable about finance and tech-savvy can be a real struggle. This can lead to slower service, fewer innovative ideas, and potentially higher error rates.

- Inefficient Management Systems: Outdated systems can make it tough to track finances, manage loans, and communicate effectively with members. Think of it as trying to organize your closet with a broken hanger – chaos!

Daftar Kelemahan yang Perlu Segera Diatasi

These weaknesses aren’t just annoying; they can seriously impact the credit union’s success. It’s time for some major upgrades!

Analisis SWOT Koperasi Simpan Pinjam 2025 penting untuk melihat peluang dan tantangan ke depan. Kita perlu memahami persaingan yang ketat, salah satunya dari pinjaman online yang semakin marak. Untuk gambaran lebih jelas tentang tren ini, silahkan lihat Tabel Pinjaman Online 2025 yang memberikan data terkini. Dengan memahami data tersebut, kita dapat menyusun strategi yang tepat dalam analisis SWOT Koperasi Simpan Pinjam 2025 agar tetap kompetitif dan bermanfaat bagi anggota.

- Implement modern technology and digital solutions.

- Invest in employee training and development programs.

- Upgrade management systems to improve efficiency and accuracy.

- Improve internal communication and collaboration.

Dampak Negatif dari Setiap Kelemahan

Ignoring these issues can lead to some major problems. Let’s break it down:

- Limited Technology: Loss of members to competitors offering better digital services, reduced efficiency, and a less appealing user experience.

- Shortage of Skilled Personnel: Poor service, higher error rates, difficulty adapting to changing market conditions, and missed opportunities for growth.

- Inefficient Management Systems: Increased operational costs, inaccurate financial reporting, difficulty in making informed decisions, and increased risk of fraud.

Perbandingan Kelemahan dengan Kompetitor

Let’s be honest, credit unions are facing some serious competition from banks and fintech companies. These competitors often have better tech, more resources, and broader reach. It’s a tough crowd, but not impossible to compete with.

For example, a smaller credit union might lack the sophisticated fraud detection systems of a major bank, putting its members at a higher risk. Or, they might not offer the same range of financial products, limiting their appeal to potential members.

Rencana Perbaikan untuk Mengatasi Kelemahan

So, what’s the game plan? These credit unions need a serious makeover to stay relevant. This isn’t about a quick fix; it’s about a long-term commitment to improvement.

A solid plan might involve securing funding for technology upgrades, implementing employee training programs, and partnering with fintech companies to enhance their services. Think of it as a total body overhaul – from head to toe!

They also need to focus on building a strong brand identity that emphasizes their community focus and personal service. This can help them stand out from the competition and attract new members.

Analisis SWOT Koperasi Simpan Pinjam 2025 penting untuk melihat peluang dan ancaman di masa depan. Salah satu ancaman yang perlu dipertimbangkan adalah risiko kredit, terutama masalah seperti yang dibahas di artikel Teman Pinjam Uang Tapi Tidak Dikembalikan 2025 , yang menggambarkan betapa sulitnya menagih pinjaman dari kenalan. Memahami risiko ini akan membantu koperasi menyusun strategi yang lebih efektif dalam pengelolaan risiko dan meningkatkan sistem penjaminan agar tetap sehat dan berkelanjutan.

Dengan demikian, analisis SWOT menjadi kunci keberhasilan Koperasi Simpan Pinjam di tahun 2025.

Mengeksplorasi Peluang Koperasi Simpan Pinjam

Yo, peeps! Koperasi Simpan Pinjam (KSP) di tahun 2025 punya potensi *major* untuk *level up*. Dengan ekonomi yang *kinda* stabil dan teknologi finansial yang *blowing up*, ada banyak peluang emas yang bisa di-grab. Let’s dive into the juicy details!

Peluang Pertumbuhan Ekonomi Positif

A booming economy is like a sweet, sweet deal for KSPs. More people have cash to spare, meaning more savings and loan applications. This translates to increased revenue and a stronger financial position for the cooperative. Think of it as a total win-win situation, totally rad!

Analisis SWOT Koperasi Simpan Pinjam 2025 membutuhkan pemahaman mendalam tentang pasar keuangan. Kita perlu melihat berbagai strategi, termasuk membandingkan layanan kita dengan kompetitor seperti perusahaan pembiayaan besar. Sebagai contoh, memahami penawaran Pinjaman Mandala Finance 2025 dapat memberikan wawasan berharga tentang tren dan preferensi nasabah. Informasi ini kemudian dapat diintegrasikan ke dalam analisis SWOT kita, membantu koperasi mengembangkan strategi yang lebih efektif dan kompetitif di tahun 2025.

Dengan begitu, kita bisa memastikan keberlanjutan dan pertumbuhan koperasi simpan pinjam.

Peluang Kebijakan Pemerintah yang Mendukung

The government’s got your back, dude! Policies supporting KSPs can provide a significant boost, like tax breaks or subsidies. This can help KSPs expand their operations and offer better services to members. It’s like getting a free power-up in a video game, seriously awesome!

Memahami Analisis SWOT Koperasi Simpan Pinjam di tahun 2025 membutuhkan data yang akurat dan terstruktur. Ketepatan data ini sangat penting untuk memetakan peluang dan ancaman yang ada. Bayangkan saja, bagaimana kita bisa mengelola aset dengan baik jika data transaksi tidak tercatat dengan rapi, seperti halnya pentingnya Contoh Laporan Peminjaman Buku Perpustakaan 2025 yang menunjukan pengelolaan data yang baik.

Sistematika yang terorganisir, seperti pada contoh laporan tersebut, juga krusial dalam Analisis SWOT Koperasi Simpan Pinjam 2025 agar perencanaan strategi bisnis lebih efektif dan berdampak positif bagi kemajuan koperasi.

Peluang Perkembangan Teknologi Finansial

Tech is totally changing the game. Digital platforms and fintech solutions can streamline operations, improve efficiency, and reach a wider customer base. Imagine mobile apps for deposits and loans, that’s next level stuff! It’s like adding a turbocharger to your KSP, making it faster and more efficient.

Daftar Peluang yang Berpotensi Meningkatkan Kinerja Koperasi

- Meningkatkan layanan digital (mobile apps, online banking)

- Menawarkan produk dan layanan baru (misalnya, asuransi mikro, investasi)

- Memperluas jangkauan layanan ke daerah pedesaan

- Membangun kemitraan strategis dengan lembaga keuangan lain

- Meningkatkan literasi keuangan anggota

Strategi Memanfaatkan Peluang dan Prioritasnya

Prioritizing opportunities is key. Focusing on digitalization is a no-brainer. It’s the most promising because it opens doors to a larger market and improves efficiency. It’s a total game changer!

| Peluang | Strategi | Timeline |

|---|---|---|

| Pengembangan aplikasi mobile banking | Kerjasama dengan developer aplikasi, pelatihan karyawan | 6 bulan – 1 tahun |

| Ekspansi ke daerah pedesaan | Riset pasar, kerjasama dengan pemerintah daerah | 1-2 tahun |

| Kemitraan strategis | Identifikasi mitra potensial, negosiasi kerjasama | 3-6 bulan |

Menentukan Threats (Ancaman) Koperasi Simpan Pinjam

Yo, peeps! Let’s get real about the threats facing our fave co-ops. It’s not all sunshine and rainbows in the world of saving and lending, and understanding these potential pitfalls is, like, totally crucial for long-term success. We’re talkin’ about serious stuff that could, like, totally crash the party if we’re not careful. Think of it as a preemptive strike against potential drama.

Analisis SWOT Koperasi Simpan Pinjam 2025 sangat penting untuk melihat peluang dan tantangan ke depan. Salah satu faktor krusial yang perlu dipertimbangkan adalah kebijakan suku bunga pinjaman. Melihat contohnya, kita bisa mempelajari Bunga Pinjaman Koperasi Swasti Sari 2025 sebagai studi kasus yang relevan. Informasi ini akan membantu kita dalam merumuskan strategi yang tepat dalam analisis SWOT, khususnya dalam menilai daya saing dan profitabilitas koperasi di masa mendatang.

Dengan pemahaman yang komprehensif, Analisis SWOT Koperasi Simpan Pinjam 2025 akan menjadi lebih akurat dan efektif.

This section will totally break down the external threats that could throw a wrench in the works for our co-op. We’ll identify these threats, analyze their potential impact, and brainstorm some killer strategies to, like, totally dodge those bullets. Think of it as our ultimate survival guide – because, let’s be honest, surviving in this economic jungle is no walk in the park.

Persaingan yang Ketat

Okay, so the co-op game ain’t exactly a solo act. We’ve got a bunch of other players vying for the same customers, offering similar services. This competition can be fierce, especially with the rise of fintech companies and online banking platforms that are, like, totally disrupting the traditional banking landscape. It’s a total “survival of the fittest” situation.

- Threat: Loss of market share to competitors offering better rates, more convenient services, or innovative features.

- Negative Impact: Reduced profitability, decreased member base, and potential loss of market dominance.

- Mitigation Strategy: Enhance customer service, offer competitive interest rates, and develop innovative products and services to stay ahead of the curve. Think loyalty programs, killer apps, and personalized financial advice – the whole shebang!

- Contingency Plan: Explore strategic partnerships, mergers, or acquisitions to expand market reach and enhance competitiveness. Maybe even a total rebranding – think of it as a total makeover for the co-op.

Perubahan Regulasi

Rules and regulations, ugh. They’re always changing, and keeping up with them can be a total drag. New laws and policies can significantly impact how co-ops operate, creating a whole new set of challenges to navigate. It’s like playing a game where the rules change every five minutes.

- Threat: Increased compliance costs, changes in lending practices, and potential fines for non-compliance.

- Negative Impact: Reduced profitability, operational inefficiencies, and reputational damage.

- Mitigation Strategy: Stay updated on regulatory changes, invest in compliance training, and develop robust internal controls. Basically, we gotta be on top of our game and know the rules better than anyone else.

- Contingency Plan: Engage with regulatory bodies, seek legal advice, and allocate resources to address compliance issues promptly. Think of it as our “legal shield” against potential lawsuits or penalties.

Fluktuasi Ekonomi

The economy, dude, it’s a rollercoaster. Ups and downs are totally normal, but significant economic fluctuations can seriously impact the co-op’s financial health. Recessions, inflation, and changes in interest rates can all throw a major wrench in the works.

- Threat: Increased loan defaults, reduced savings deposits, and decreased investment returns.

- Negative Impact: Reduced profitability, financial instability, and potential insolvency.

- Mitigation Strategy: Diversify investment portfolios, implement robust risk management practices, and maintain adequate capital reserves. Basically, we need a solid financial safety net.

- Contingency Plan: Develop a comprehensive crisis management plan to address potential financial downturns and ensure business continuity. Think of it as our emergency kit for tough times.

Strategi dan Rekomendasi untuk Koperasi Simpan Pinjam: Analisis Swot Koperasi Simpan Pinjam 2025

Okay, so we’ve totally dissected the SWOT analysis, right? Now it’s time to get this show on the road and lay out some killer strategies for this co-op. Think of this as the game plan to level up the whole operation and make it, like, totally awesome. We’re talking about boosting profitability, expanding our reach, and making sure this thing is totally legit and sustainable for the long haul. No cap!

Ranguman Analisis SWOT

Based on our SWOT analysis, we’ve identified some major strengths, like our loyal member base and our strong community ties. But, we also see some weaknesses, such as limited tech skills and a small marketing budget. Opportunities are out there, like expanding our digital services and tapping into new markets. But, we also need to watch out for threats, such as increased competition and economic downturns. It’s a total mix of good and bad, you know?

Rekomendasi Strategi Berdasarkan Analisis SWOT

To totally slay it, we need a multi-pronged approach. Think of it as a strategic trifecta – a winning combo that hits all the right spots. We’re going to leverage our strengths, address our weaknesses, capitalize on opportunities, and mitigate threats. It’s all about strategic alignment, you feel me?

- Enhance Digital Services: We need to get with the times and upgrade our tech game. This means a new website, mobile app, and maybe even online loan applications. Think user-friendly and super efficient. This will attract a younger demographic and improve operational efficiency.

- Targeted Marketing Campaigns: We’re going to launch some seriously awesome marketing campaigns to reach new members. We’ll use social media, local events, and maybe even some influencer marketing. It’s all about getting our name out there and showing people what we’re all about.

- Financial Literacy Programs: We can offer workshops and seminars to educate members about financial management and responsible borrowing. This builds trust and strengthens our community ties.

- Risk Management Strategies: We’ll put in place solid risk management strategies to protect against economic downturns and increased competition. This might involve diversifying our loan portfolio and strengthening our credit evaluation processes.

Rencana Aksi untuk Menerapkan Strategi

Okay, so we’ve got the strategies, but now we need a solid plan to make it all happen. We’re talking about timelines, responsibilities, and budgets. This is where the rubber meets the road, fam.

| Strategi | Aksi | Penanggung Jawab | Jangka Waktu | Anggaran |

|---|---|---|---|---|

| Enhance Digital Services | Develop website and mobile app | IT Department | 6 months | $10,000 |

| Targeted Marketing Campaigns | Launch social media campaign | Marketing Department | 3 months | $5,000 |

| Financial Literacy Programs | Conduct workshops and seminars | Education Department | Ongoing | $2,000 per year |

| Risk Management Strategies | Review and update credit policies | Risk Management Team | 3 months | $1,000 |

Indikator Keberhasilan untuk Mengukur Efektivitas Strategi

We need some solid metrics to track our progress and see if we’re actually making a difference. We’re talking about key performance indicators (KPIs) that will show us whether our strategies are working or if we need to tweak things. It’s all about data-driven decision-making, my dude.

- Increase in new members

- Growth in loan portfolio

- Improved member satisfaction

- Reduced loan defaults

- Increased profitability

Perkiraan Dampak Penerapan Strategi terhadap Kinerja Koperasi

If we pull this off, we’re talking about some serious gains. We’re projecting a significant increase in membership, loan portfolio growth, and improved profitability. It’s all about long-term sustainability and growth. This will solidify our position as a leading co-op in the community, making us a total force to be reckoned with. Think of it as a major upgrade, a total game-changer, you know?

Manfaat Analisis SWOT untuk Koperasi Simpan Pinjam 2025

Yo, peeps! Analyzing your co-op’s SWOT (Strengths, Weaknesses, Opportunities, Threats) ain’t just some extra homework; it’s totally crucial for your future, especially in the ever-changing landscape of 2025. Think of it as a supercharged roadmap to help your co-op slay the competition and stay totally rad.

Manfaat Analisis SWOT untuk Koperasi Simpan Pinjam, Analisis Swot Koperasi Simpan Pinjam 2025

Doing a SWOT analysis gives your co-op a serious advantage. It’s like getting a total reality check—a super clear picture of where you’re at, what you’re good at, and what could totally derail your plans. By identifying your strengths and weaknesses, and then scoping out opportunities and threats, you can make strategic decisions that are totally on point. It’s all about maximizing your awesome potential and minimizing the risks that could, like, totally crash your party. This leads to better resource allocation, improved decision-making, and ultimately, a more successful and thriving co-op. It’s like leveling up your co-op game, for real.

Identifikasi Kekuatan dan Kelemahan Koperasi Simpan Pinjam

Figuring out your co-op’s strengths and weaknesses is like knowing your own superpowers and kryptonite. You gotta be honest with yourselves, fam! No sugarcoating allowed.

- Strengths (Strengths): Maybe you’ve got killer customer service, low interest rates, or a super loyal member base. Maybe your tech is on fleek, or you’re already crushing it in the digital space.

- Weaknesses (Weaknesses): Are your processes kinda clunky? Is your tech outdated? Do you lack the funds for expansion? Maybe your marketing game is weak, or your customer base is aging. Be real with yourselves!

For example, a co-op with a strong online presence and a young, tech-savvy membership base (strength) might struggle with attracting older members who prefer in-person interactions (weakness).

Peluang dan Ancaman Koperasi Simpan Pinjam di Tahun 2025

The future is, like, totally uncertain, right? But by analyzing potential opportunities and threats, you can prepare your co-op for whatever comes your way. It’s about being proactive, not reactive.

- Opportunities (Opportunities): The rise of fintech could be a major opportunity. Maybe you could partner with other businesses or explore new financial products. Maybe there’s a growing demand for sustainable finance in your area.

- Threats (Threats): Rising interest rates, economic downturns, or increased competition from banks and fintech companies are all major threats. Changes in regulations could also seriously impact your co-op. Cybersecurity threats are also a huge concern.

For instance, a growing demand for microloans in underserved communities (opportunity) might be threatened by the entry of larger, well-funded fintech companies (threat).

Pembuatan Strategi Berdasarkan Hasil Analisis SWOT

Once you’ve got your SWOT analysis nailed, it’s time to craft a killer strategy. This is where you figure out how to use your strengths to seize opportunities and mitigate your weaknesses and threats. It’s all about strategic planning, fam!

For example, a co-op with a strong brand reputation (strength) could leverage that to attract new members in a growing market (opportunity) by implementing a targeted marketing campaign (strategy). If they have a weakness in online security, they could invest in better systems (strategy) to mitigate the threat of cyberattacks.

Pengukuran Keberhasilan Strategi yang Diterapkan

After you’ve put your strategy into action, it’s time to see if it’s actually working. You gotta track your progress and make adjustments as needed. It’s all about staying on top of things and making sure your plan is still relevant.

- Key Performance Indicators (KPIs): Track things like membership growth, loan disbursement rates, profitability, and customer satisfaction.

- Regular Reviews: Schedule regular meetings to assess your progress and make adjustments as needed. Stay flexible and adapt to changes in the market.

Using these KPIs and regular reviews, you can determine if your strategies are effective and make necessary changes to ensure your co-op’s continued success. It’s all about staying agile and adapting to the ever-changing world.