Investasi Forex Trading di Tahun 2025

Investasi Forex Trading 2025 – Yo, peeps! Tahun 2025 is just around the corner, and the forex market is shaping up to be a wild ride. Think rollercoaster, but with potentially HUGE payouts (or equally HUGE losses). This ain’t your grandma’s knitting circle; this is high-stakes trading, where global economics and geopolitical events are the ultimate hype beasts. We’re diving deep into the forex forecast for 2025, exploring the potential gains and the serious risks involved. Get ready to level up your financial game!

The forex market, short for foreign exchange market, is where currencies are traded 24/7. It’s a massive, decentralized global marketplace, bigger than any stock market you can imagine. In 2025, we’re expecting continued volatility, influenced by a cocktail of global events. Think shifting economic power dynamics, technological disruptions, and of course, the ever-present unpredictable nature of geopolitics. It’s a thrilling, yet nerve-wracking, landscape for investors.

Potensi Keuntungan dan Risiko Investasi Forex Trading di Tahun 2025

The forex market offers the potential for massive returns. We’re talking about the possibility of making serious bank, especially if you’ve got the skills and knowledge to navigate its complexities. However, let’s be real – it’s a double-edged sword. The risks are equally substantial. Losing your entire investment is a real possibility if you’re not careful. It’s a high-risk, high-reward game, so approach it with caution and a solid understanding of the market.

Think of it like this: you could hit the jackpot, becoming a forex trading legend, or you could end up needing to sell your prized collection of limited-edition sneakers to cover your losses. The choice is yours, but smart decisions are key.

Faktor-faktor Makroekonomi Global yang Berpotensi Mempengaruhi Pasar Forex di Tahun 2025

Several macroeconomic factors are poised to significantly impact the forex market in 2025. These aren’t just whispers; these are major players influencing the game. Think of them as the A-list celebrities of the global economy.

Investasi Forex Trading 2025 menuntut ketelitian dan perencanaan matang. Keberhasilan bergantung pada berbagai faktor, termasuk pemahaman yang baik tentang waktu transaksi. Untuk memaksimalkan potensi keuntungan, penting mengetahui Jam Open Market Forex 2025 , karena waktu pembukaan pasar berpengaruh signifikan terhadap volatilitas dan likuiditas. Dengan memahami jam operasional pasar, Anda dapat menyusun strategi investasi Forex Trading 2025 yang lebih efektif dan terarah, meningkatkan peluang meraih hasil optimal.

Oleh karena itu, selalu pantau dan perhatikan informasi terkait waktu pasar ini.

- Inflasi Global: Persistent inflation in major economies could lead to significant currency fluctuations. Remember the inflation spikes of the 70s and 80s? That kind of volatility could be on the horizon.

- Kebijakan Moneter Bank Sentral: Decisions made by central banks, like the Federal Reserve (the Fed) in the US, will directly influence interest rates and currency values. These decisions are the equivalent of major plot twists in our forex drama.

- Pertumbuhan Ekonomi Global: Strong economic growth in certain regions will likely boost their currencies, while sluggish growth could weaken them. Think of it as a global economic tug-of-war.

- Geopolitik: International conflicts, trade wars, and political instability can all create significant market uncertainty and volatility. This is the unpredictable wild card that can throw everything off balance.

Perbandingan Beberapa Strategi Investasi Forex yang Populer

Choosing the right strategy is crucial for success in forex trading. It’s like picking the right weapon in a video game; the wrong choice could cost you the match. Here’s a breakdown of some popular approaches:

| Strategi | Keuntungan | Risiko | Cocok untuk Investor |

|---|---|---|---|

| Scalping | Keuntungan kecil, tetapi sering | Risiko tinggi, membutuhkan disiplin tinggi | Trader berpengalaman dengan toleransi risiko tinggi |

| Day Trading | Potensi keuntungan yang lebih besar dibandingkan scalping | Risiko sedang hingga tinggi, membutuhkan analisis teknikal yang kuat | Trader aktif dengan pemahaman pasar yang baik |

| Swing Trading | Potensi keuntungan yang besar, waktu holding lebih lama | Risiko sedang, membutuhkan analisis fundamental dan teknikal | Investor dengan toleransi risiko sedang dan waktu luang yang terbatas |

| Investing (Long-Term) | Potensi keuntungan jangka panjang, risiko lebih rendah | Risiko rendah, membutuhkan kesabaran dan pemahaman fundamental | Investor konservatif dengan tujuan jangka panjang |

Contoh Skenario Investasi Forex di Tahun 2025

Let’s imagine a few scenarios to illustrate the potential ups and downs. Remember, these are just examples, not financial advice. Always do your own research before making any investment decisions.

Skenario 1 (Risiko Rendah): An investor allocates a small portion of their portfolio to a diversified currency basket, focusing on stable currencies like the Swiss Franc or Japanese Yen. This strategy aims for slow and steady growth, minimizing risk. Think of it as a safe, low-key investment strategy.

Skenario 2 (Risiko Sedang): An investor uses swing trading to capitalize on short-term market fluctuations, focusing on emerging market currencies with high growth potential. This requires careful analysis and timing, and carries a moderate level of risk. It’s a bit more of a high-octane approach.

Skenario 3 (Risiko Tinggi): A trader employs a high-frequency scalping strategy, aiming for small but frequent profits. This approach demands intense focus, rapid decision-making, and a high tolerance for risk. This is definitely not for the faint of heart. It’s like playing poker with sharks.

Analisis Pasar dan Prediksi Tren Forex 2025

Yo, peeps! Let’s dive into the wild world of forex trading and predict what 2025 might bring. Think of this as our crystal ball, but instead of predicting the future of your love life, we’re looking at currency fluctuations. It’s gonna be a rollercoaster, so buckle up!

Pergerakan Nilai Tukar Mata Uang Utama di 2025

Predicting currency movements is like trying to catch a greased pig – tricky, but not impossible. Several factors will influence major currencies in 2025. Global economic growth, inflation rates, and geopolitical events will all play a major role. Think of the US dollar (USD) – its strength often depends on the overall health of the US economy. A strong economy usually means a strong dollar, but unexpected events can totally flip the script. For example, if the US enters a recession, the USD could weaken significantly, potentially boosting other currencies like the Euro (EUR) or the British Pound (GBP).

Pasangan Mata Uang dengan Potensi Pertumbuhan Tertinggi di 2025

Picking winning currency pairs is like choosing the next big hit song – a gamble with potentially huge rewards. However, we can analyze historical trends and current economic indicators to make educated guesses. For instance, emerging market currencies often show significant growth, but they also carry more risk. Pairs like USD/IDR (US Dollar/Indonesian Rupiah) and EUR/TRY (Euro/Turkish Lira) could potentially offer high growth, but it’s crucial to understand the associated volatility. On the other hand, established pairs like EUR/USD and GBP/USD might offer more stability, although their growth potential might be less explosive.

Investasi Forex Trading 2025 menuntut pemahaman mendalam akan pasar global. Keberhasilan bergantung pada strategi yang tepat dan analisa yang cermat. Untuk memahami regulasi dan perkembangan pasar di tanah air, silahkan kunjungi Forex Di Indonesia 2025 untuk wawasan lebih lanjut. Informasi ini akan membantu Anda menyusun rencana investasi Forex Trading 2025 yang lebih terarah dan bijak, menyesuaikan strategi dengan kondisi pasar domestik yang dinamis.

Dengan persiapan yang matang, investasi Anda akan lebih berpeluang meraih hasil yang optimal.

Dampak Perkembangan Teknologi terhadap Pasar Forex di 2025

AI and big data are changing the game, y’all. Algorithms are now analyzing massive datasets to identify trading opportunities and predict market trends with impressive accuracy. This means faster execution speeds and potentially more efficient trading strategies. However, this also increases competition, as everyone is using similar tools. It’s like a tech arms race in the forex world, so traders need to stay updated and adapt to the latest innovations to stay ahead of the curve.

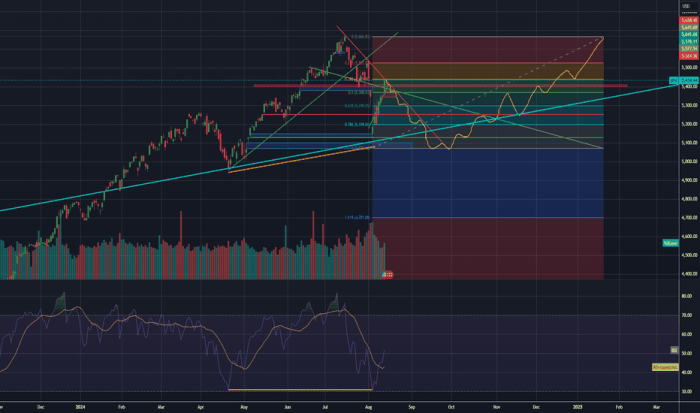

Proyeksi Pergerakan Nilai Tukar

Now, for the juicy part – the charts! Remember, these are projections based on current trends and educated guesses, not set in stone. Think of them as educated hunches rather than guarantees.

| Pasangan Mata Uang | Proyeksi 2025 | Deskripsi |

|---|---|---|

| USD/IDR | 15.000 – 16.000 | Assuming continued economic growth in Indonesia, the IDR might appreciate slightly against the USD, but still remain within a relatively stable range. However, global economic uncertainty could push it higher. |

| EUR/USD | 1.10 – 1.20 | This pair’s movement will heavily depend on the relative economic performance of the US and the Eurozone. A strong Eurozone economy could push the EUR/USD higher, while a stronger US economy could push it lower. This is a classic battle of the economic titans. |

| GBP/USD | 1.25 – 1.35 | Similar to EUR/USD, this pair’s movement will depend on the economic performance of both the UK and the US. Brexit’s lingering effects and global economic factors will play a significant role in determining its trajectory. |

Pengaruh Geopolitik terhadap Pasar Forex di 2025

Geopolitical events are the ultimate wild cards. Think unexpected wars, political instability, or major international agreements – these can send shockwaves through the forex market. For example, increased tensions between major world powers could cause investors to flee to “safe haven” currencies like the USD or JPY (Japanese Yen), leading to a strengthening of these currencies and weakening of others. It’s a constant game of risk assessment, and staying informed about global events is crucial for any forex trader.

Strategi Investasi Forex yang Efektif di Tahun 2025

Yo, peeps! Forex trading di 2025? It’s gonna be a wild ride, a rollercoaster of profits and potential losses. But don’t sweat it, we’re breaking down some killer strategies to help you navigate this exciting market. Think of this as your cheat sheet to forex success. Get ready to level up your trading game!

Strategi Perdagangan Forex: Scalping, Day Trading, dan Swing Trading

Okay, so you’ve got three main players in the forex game: scalping, day trading, and swing trading. Each one’s got its own vibe, its own risk profile, and its own potential payday. Let’s break it down, shall we?

- Scalping: This is the short-game, the quick in and out. You’re aiming for small profits on tons of trades. Think of it like a speed demon, high-frequency trading, super fast-paced. High risk, high reward, but it demands serious focus and lightning-fast reflexes. It’s not for the faint of heart.

- Day Trading: A bit more chill than scalping. You open and close your positions within the same trading day. It’s like a marathon, not a sprint. You’re looking at slightly larger profit targets but still keeping it relatively short-term. The risk is still pretty high, but you’ve got a bit more breathing room.

- Swing Trading: This is the long game, the slow and steady approach. You hold your positions for days, or even weeks. Think of it as a well-planned investment, rather than a quick hit. Lower risk, slower rewards. This is where patience pays off. It’s like building a solid foundation, brick by brick.

Langkah-langkah Swing Trading Forex, Investasi Forex Trading 2025

Swing trading? It’s all about riding those market waves. Here’s how to rock it:

- Identify the Trend: First things first, you gotta know where the market’s headed. Use technical analysis tools – those charts are your best friend. Look for those strong trends.

- Choose Your Pairs: Pick your currency pairs wisely. Research is key! Consider the economic factors influencing those currencies.

- Set Your Entry and Exit Points: Use indicators and support/resistance levels to pinpoint your entry and exit points. This minimizes emotional trading and keeps you on track.

- Manage Your Risk: Always use stop-loss orders. This protects your capital from major blow-ups. Don’t be reckless!

- Monitor and Adjust: Keep an eye on the market. Things change, so be prepared to adjust your strategy if necessary.

Contoh Penerapan Hedging untuk Meminimalkan Risiko

Hedging is your insurance policy in the forex world. It’s all about reducing risk by offsetting potential losses. Let’s say you’re long on EUR/USD. A hedge might involve taking a short position on a related pair, like USD/JPY, to balance out potential losses if the EUR weakens.

Investasi Forex Trading 2025 menuntut pemahaman mendalam pasar. Keberhasilan bergantung pada strategi tepat dan manajemen risiko yang bijak. Untuk mengasah kemampuan analisis dan pengambilan keputusan, manfaatkan kesempatan belajar dari para ahli melalui sesi Live Forex Trading 2025. Dengan pengalaman langsung ini, Anda dapat meningkatkan keterampilan trading dan menyesuaikan strategi investasi Forex Trading 2025 Anda agar lebih efektif dan terukur.

Keberhasilan investasi jangka panjang memerlukan konsistensi dan pembelajaran berkelanjutan.

Imagine you’re betting on a specific football team. Hedging would be like betting a small amount on the opposing team to lessen the impact of a loss. It’s not about guaranteeing a win, but it softens the blow if things go south.

Portofolio Investasi Forex yang Terdiversifikasi untuk Tahun 2025

Diversification is the name of the game. Don’t put all your eggs in one basket! Spread your investments across different currency pairs to reduce risk. Consider factors like economic stability, political climate, and market volatility when building your portfolio. A well-diversified portfolio is like a well-rounded team – it’s got strength in numbers!

Think of it like a playlist – you wouldn’t only listen to one artist, right? You’d have a mix of genres, artists, and tempos. Your forex portfolio should be the same – a mix of different currency pairs to balance risk and potential reward.

Investasi Forex Trading 2025 menuntut pemahaman mendalam akan pasar. Salah satu strategi yang perlu dipertimbangkan adalah Forex Day Trading, dimana kita memanfaatkan fluktuasi harga dalam satu hari. Untuk mempelajari lebih lanjut tentang strategi ini, silahkan kunjungi panduan lengkapnya di Forex Day Trading 2025. Memahami Forex Day Trading akan membantu Anda menyusun strategi investasi Forex Trading 2025 yang lebih efektif dan terukur, mengurangi risiko dan memaksimalkan potensi keuntungan.

Dengan perencanaan yang matang, investasi Anda akan lebih berkah.

Manajemen Risiko dalam Investasi Forex

Yo, peeps! Forex trading bisa jadi super lucrative, but it’s also a rollercoaster. Think of it like riding a wild bronco – exhilarating, but you gotta stay in the saddle to avoid getting bucked off. That’s where risk management comes in. It’s your safety net, your life vest in the shark-infested waters of the forex market. Without it, you’re basically playing Russian roulette with your hard-earned cash. Let’s dive into some key strategies to keep your trading game strong and your bank account healthy.

Investasi Forex Trading 2025 menjanjikan potensi keuntungan besar, namun memerlukan modal awal. Bagi yang ingin memulai tanpa beban finansial, perlu dipertimbangkan akses Modal Gratis Trading Forex 2025 yang mungkin tersedia. Manfaatkan kesempatan ini untuk mempelajari seluk-beluk pasar dan strategi trading sebelum menginvestasikan dana pribadi. Dengan pengetahuan dan pengalaman yang cukup, Anda dapat memaksimalkan potensi investasi Forex Trading 2025 dan meraih kesuksesan finansial.

Jenis-jenis Risiko dalam Investasi Forex

The forex market throws a lot of curveballs. Knowing the risks is the first step to dodging them. We’re talking about market risk (price fluctuations, dude!), liquidity risk (not being able to get in or out of a trade quickly), and operational risk (technical glitches, human error – stuff that’s totally out of your control). Understanding these risks is like knowing the terrain before you hit the trail. You wouldn’t go hiking Mount Everest without a map, would you?

Investasi Forex Trading 2025 menjanjikan potensi keuntungan besar, namun membutuhkan pemahaman mendalam. Sebelum terjun, persiapkan diri dengan baik melalui panduan langkah awal yang tepat. Pelajari strategi dasar dan manajemen risiko yang efektif dengan mengunjungi panduan lengkap Cara Forex Pemula 2025 untuk meminimalisir kerugian. Dengan bekal pengetahuan yang cukup, Anda dapat memaksimalkan peluang sukses dalam Investasi Forex Trading 2025 dan meraih hasil yang optimal.

Ingatlah, kesabaran dan disiplin adalah kunci keberhasilan dalam dunia perdagangan ini.

Teknik Manajemen Risiko yang Efektif

Okay, so you know the risks. Now, let’s talk about how to handle them. This is where the real magic happens. Think of it as your arsenal of weapons against the forex market’s unpredictable nature. Two of the most crucial tools in your arsenal are stop-loss and take-profit orders. Stop-loss orders are your emergency brakes, automatically selling your position when it hits a certain price to limit your losses. Take-profit orders are your victory celebrations, automatically selling when your position hits your target profit, securing your gains.

Investasi Forex Trading 2025 menuntut disiplin dan perencanaan matang. Keberhasilan bergantung pada pemahaman pasar dan manajemen risiko yang baik. Untuk meningkatkan kemampuan analisis dan evaluasi trading Anda, sangat dianjurkan untuk mencatat setiap transaksi dan strategi yang digunakan. Catatlah semuanya dalam Jurnal Trading Forex 2025 agar pembelajaran berkelanjutan tercipta. Dengan demikian, Investasi Forex Trading 2025 Anda akan semakin terarah dan terukur, meminimalisir kerugian dan memaksimalkan potensi keuntungan.

Jadikan jurnal ini sebagai panduan ibadah Anda dalam berinvestasi, penuh kehati-hatian dan perhitungan.

Contoh Perhitungan Risiko dan Reward

Let’s say you’re trading EUR/USD. You’re feeling bullish and think the euro is gonna rise. You decide to buy 1 lot (100,000 units) of EUR/USD at 1.1000. You set a stop-loss order at 1.0980 (a 20-pip stop-loss) and a take-profit order at 1.1030 (a 30-pip take-profit). Your potential loss is 20 pips x 10 USD/pip = 200 USD. Your potential profit is 30 pips x 10 USD/pip = 300 USD. Your risk-reward ratio is 1:1.5. This means for every dollar you risk, you stand to gain $1.50. Always aim for a favorable risk-reward ratio – it’s like getting more bang for your buck!

Pentingnya Disiplin dan Pengendalian Emosi

Forex trading is a marathon, not a sprint. Success requires patience, discipline, and a cool head. Emotional trading – letting fear and greed dictate your decisions – is a recipe for disaster. Stick to your trading plan, manage your risks, and avoid impulsive trades. Remember, consistency and discipline are your best allies in this game.

Tips Mengelola Emosi Saat Trading Forex

- Develop a solid trading plan and stick to it religiously. No impulse buys or sells!

- Keep a trading journal to track your progress and identify emotional triggers.

- Practice mindfulness and meditation to stay calm under pressure.

- Take breaks when needed to avoid emotional burnout. Step away from the charts!

- Don’t let winning streaks get to your head, nor losing streaks break your spirit. It’s all part of the game.

- Consider seeking guidance from a mentor or coach. A second opinion can be invaluable.

Perkembangan Teknologi dan Investasi Forex

Yo, peeps! Forex trading di 2025? It’s gonna be a wild ride, fueled by tech advancements that are straight outta a sci-fi flick. Forget dial-up modems; we’re talking AI, machine learning, and blockchain—all shaking up the game in major ways. Get ready to level up your trading skills, because the future is now!

Pengaruh AI dan Machine Learning pada Strategi Investasi Forex

Artificial intelligence (AI) and machine learning (ML) are no longer just buzzwords; they’re game-changers. These technologies are crunching massive datasets of historical forex data, identifying patterns and trends that would take a human trader years to spot. Think of it as having a super-powered analyst working 24/7, analyzing market movements and predicting price fluctuations with uncanny accuracy. This allows for the development of sophisticated trading algorithms and strategies that adapt to changing market conditions in real-time. For example, an AI-powered system might identify a correlation between specific economic indicators and currency movements, allowing for more precise entry and exit points.

Peran Platform Trading Otomatis dan Robot Trading

Automated trading platforms and robot advisors (or “robots”) are becoming increasingly popular. These systems execute trades based on pre-programmed algorithms, eliminating emotional biases and allowing for consistent execution of trading strategies. Imagine a robot that tirelessly monitors the market, identifying opportunities and executing trades with lightning speed and precision, all without needing coffee breaks or sleep. Some platforms offer customizable parameters, allowing traders to fine-tune their robots’ strategies to match their risk tolerance and investment goals. Think of it as your personal, tireless trading assistant.

Manfaat dan Risiko Penggunaan Teknologi dalam Trading Forex

The tech revolution in forex trading offers massive upsides, but it’s not all sunshine and rainbows. On the plus side, we’re talking about increased efficiency, reduced emotional trading, and potentially higher returns. However, there’s also the risk of system malfunctions, unexpected market volatility, and the potential for over-reliance on technology. It’s like driving a supercar – exhilarating, but you need to know how to handle it. A balanced approach, combining technological tools with human oversight, is key.

Perbandingan Trading Manual dan Trading Otomatis

| Fitur | Trading Manual | Trading Otomatis |

|---|---|---|

| Keterlibatan Manusia | Tinggi | Rendah |

| Kecepatan Eksekusi | Rendah | Tinggi |

| Biaya | Relatif rendah (kecuali biaya pendidikan dan pelatihan) | Potensi biaya platform/langganan yang tinggi |

| Fleksibelitas | Tinggi | Terbatas pada parameter yang telah diprogram |

| Potensi Keuntungan | Bergantung pada keahlian trader | Bergantung pada keakuratan algoritma |

| Potensi Risiko | Bergantung pada kemampuan pengelolaan risiko trader | Bergantung pada keandalan algoritma dan perlindungan risiko yang terpasang |

Pengaruh Perkembangan Blockchain pada Pasar Forex

Blockchain technology, the backbone of cryptocurrencies, is poised to disrupt the forex market. Its decentralized and transparent nature could lead to increased efficiency and security in forex transactions. Imagine a system where transactions are recorded immutably on a distributed ledger, reducing the risk of fraud and enhancing trust. This could streamline the process of international money transfers and potentially reduce transaction costs. While still in its early stages of adoption in the forex world, the potential impact of blockchain is significant and worth keeping an eye on. It’s like a digital revolution, reimagining how we handle global currency exchange.

Pertanyaan Umum tentang Investasi Forex Trading di 2025: Investasi Forex Trading 2025

Forex trading, atau perdagangan mata uang asing, bisa jadi terasa seperti naik roller coaster—menyenangkan, menegangkan, dan penuh kejutan. Tahun 2025 menjanjikan peluang baru, tetapi juga tantangan yang perlu dipertimbangkan. Panduan ini akan memberikan jawaban atas pertanyaan umum seputar investasi forex trading di tahun mendatang, membantu Anda menavigasi dunia trading dengan lebih percaya diri. Think of it as your cheat sheet to Forex success!

Apakah Investasi Forex Cocok untuk Pemula?

Forex trading bukanlah permainan anak-anak, tapi juga bukan hanya untuk para ahli. Sebagai pemula, Anda perlu memahami bahwa risiko kerugian ada, dan itu nyata. Namun, dengan pendekatan yang tepat, forex bisa menjadi investasi yang menguntungkan. Kunci sukses terletak pada pendidikan dan disiplin. Jangan langsung terjun ke laut dalam sebelum belajar berenang!

- Pendidikan: Mulailah dengan mempelajari dasar-dasar forex, termasuk pasangan mata uang, analisis teknikal dan fundamental, serta manajemen risiko. Banyak sumber daya online dan buku yang bisa membantu.

- Akun Demo: Praktikkan strategi trading Anda dengan akun demo sebelum menggunakan uang sungguhan. Ini seperti latihan di lapangan sebelum pertandingan sesungguhnya.

- Mulai Kecil: Jangan langsung menginvestasikan seluruh tabungan Anda. Mulailah dengan modal kecil untuk membatasi potensi kerugian.

- Cari Mentor: Bergabunglah dengan komunitas trading atau cari mentor yang berpengalaman untuk mendapatkan bimbingan dan berbagi pengalaman.

Modal Minimal untuk Memulai Investasi Forex

Tidak ada batasan modal minimum yang baku untuk memulai trading forex. Banyak broker menawarkan akun mikro dengan deposit awal yang rendah, bahkan bisa serendah $5 atau setara dengannya dalam mata uang lain. Namun, ingatlah bahwa modal kecil membatasi potensi keuntungan dan strategi trading yang bisa Anda gunakan. Think of it like this: a smaller budget means a smaller playground.

Contoh: Beberapa broker menawarkan akun mikro dengan deposit awal $5-$100. Dengan modal ini, Anda bisa berlatih dan mempelajari pasar tanpa risiko terlalu besar. Namun, untuk strategi trading yang lebih kompleks dan diversifikasi portofolio, modal yang lebih besar akan sangat membantu.

Cara Memilih Broker Forex yang Terpercaya

Memilih broker forex yang tepat adalah seperti memilih partner dalam perjalanan trading Anda. Broker yang terpercaya akan memastikan keamanan dana Anda dan memberikan layanan yang handal. Jangan sampai terjebak dengan broker abal-abal!

- Regulasi: Pastikan broker teregulasi oleh otoritas keuangan yang kredibel, seperti FCA (Inggris), ASIC (Australia), atau NFA (Amerika Serikat).

- Reputasi: Cari ulasan dan testimoni dari trader lain. Lihat apakah broker tersebut memiliki reputasi yang baik dan transparan.

- Spread dan Komisi: Bandingkan biaya trading dari beberapa broker untuk mendapatkan penawaran terbaik.

- Platform Trading: Pastikan platform trading yang ditawarkan mudah digunakan dan memiliki fitur yang Anda butuhkan.

- Customer Support: Periksa kualitas layanan pelanggan. Responsif dan membantu adalah kunci.

Biaya yang Perlu Dipertimbangkan dalam Investasi Forex

Trading forex tidak gratis. Ada beberapa biaya yang perlu Anda pertimbangkan untuk menghindari kejutan di akhir bulan. Ini adalah biaya-biaya yang umum dijumpai, jadi jangan sampai kaget!

- Spread: Selisih antara harga bid dan ask. Ini adalah biaya utama dalam trading forex.

- Komisi: Beberapa broker mengenakan komisi per transaksi.

- Swap/Rollover Fee: Biaya yang dikenakan jika Anda mempertahankan posisi trading Anda melewati satu hari.

- Biaya Penarikan Dana: Beberapa broker mungkin mengenakan biaya untuk penarikan dana.

Cara Meminimalkan Risiko Kerugian dalam Investasi Forex

Risiko kerugian dalam forex trading adalah sesuatu yang tidak bisa dihindari sepenuhnya, tapi bisa diminimalkan. Jangan pernah menganggap enteng risiko, karena hal itu bisa menjadi bumerang!

- Manajemen Risiko: Gunakan stop-loss order untuk membatasi kerugian pada setiap trading.

- Diversifikasi: Jangan hanya berfokus pada satu pasangan mata uang. Diversifikasi portofolio Anda untuk mengurangi risiko.

- Analisis Pasar: Lakukan analisis teknikal dan fundamental sebelum membuka posisi trading.

- Jangan Emosional: Hindari trading berdasarkan emosi. Buat keputusan trading berdasarkan analisis dan strategi yang telah Anda buat.

- Pendidikan Berkelanjutan: Terus belajar dan tingkatkan pengetahuan Anda tentang forex trading.